Page 11 - Budget Newsletter November 2022

P. 11

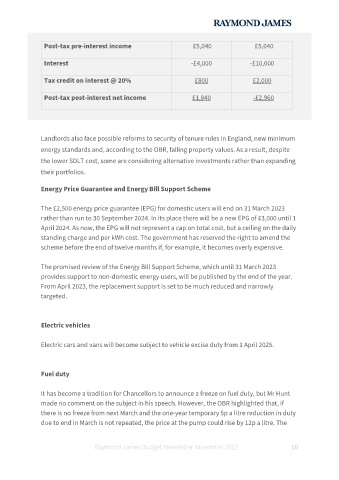

Post-tax pre-interest income £5,040 £5,040

Interest -£4,000 -£10,000

Tax credit on interest @ 20% £800 £2,000

Post-tax post-interest net income £1,840 -£2,960

Landlords also face possible reforms to security of tenure rules in England, new minimum

energy standards and, according to the OBR, falling property values. As a result, despite

the lower SDLT cost, some are considering alternative investments rather than expanding

their portfolios.

Energy Price Guarantee and Energy Bill Support Scheme

The £2,500 energy price guarantee (EPG) for domestic users will end on 31 March 2023

rather than run to 30 September 2024. In its place there will be a new EPG of £3,000 until 1

April 2024. As now, the EPG will not represent a cap on total cost, but a ceiling on the daily

standing charge and per kWh cost. The government has reserved the right to amend the

scheme before the end of twelve months if, for example, it becomes overly expensive.

The promised review of the Energy Bill Support Scheme, which until 31 March 2023

provides support to non-domestic energy users, will be published by the end of the year.

From April 2023, the replacement support is set to be much reduced and narrowly

targeted.

Electric vehicles

Electric cars and vans will become subject to vehicle excise duty from 1 April 2025.

Fuel duty

It has become a tradition for Chancellors to announce a freeze on fuel duty, but Mr Hunt

made no comment on the subject in his speech. However, the OBR highlighted that, if

there is no freeze from next March and the one-year temporary 5p a litre reduction in duty

due to end in March is not repeated, the price at the pump could rise by 12p a litre. The

Raymond James Budget Newsletter November 2022 10