Page 13 - Budget Newsletter November 2022

P. 13

Universal Credit (UC) claimants will be able to apply for a loan under the Support for

Mortgage Interest provisions after three months, rather than the current nine. The zero

earnings rule will also be abolished, allowing UC claimants in work to continue receiving

support. These changes will take effect in Spring 2023.

Planning point

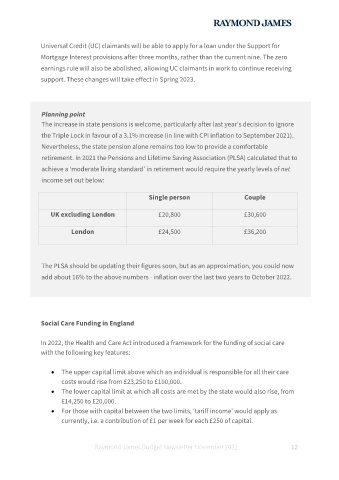

The increase in state pensions is welcome, particularly after last year’s decision to ignore

the Triple Lock in favour of a 3.1% increase (in line with CPI inflation to September 2021).

Nevertheless, the state pension alone remains too low to provide a comfortable

retirement. In 2021 the Pensions and Lifetime Saving Association (PLSA) calculated that to

achieve a ‘moderate living standard’ in retirement would require the yearly levels of net

income set out below:

Single person Couple

UK excluding London £20,800 £30,600

London £24,500 £36,200

The PLSA should be updating their figures soon, but as an approximation, you could now

add about 16% to the above numbers - inflation over the last two years to October 2022.

Social Care Funding in England

In 2022, the Health and Care Act introduced a framework for the funding of social care

with the following key features:

• The upper capital limit above which an individual is responsible for all their care

costs would rise from £23,250 to £100,000.

• The lower capital limit at which all costs are met by the state would also rise, from

£14,250 to £20,000.

• For those with capital between the two limits, ‘tariff income’ would apply as

currently, i.e. a contribution of £1 per week for each £250 of capital.

Raymond James Budget Newsletter November 2022 12