Page 10 - Budget Newsletter November 2022

P. 10

Previous announcements remaining in force

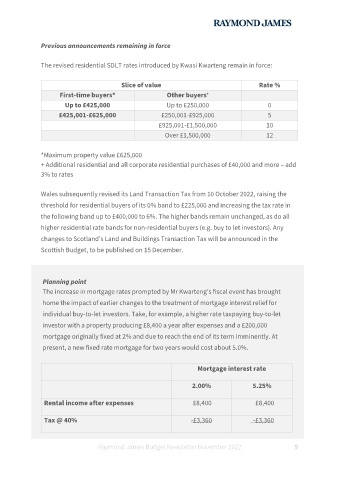

The revised residential SDLT rates introduced by Kwasi Kwarteng remain in force:

Slice of value Rate %

First-time buyers* Other buyers

+

Up to £425,000 Up to £250,000 0

£425,001-£625,000 £250,001-£925,000 5

£925,001-£1,500,000 10

Over £1,500,000 12

*Maximum property value £625,000

+ Additional residential and all corporate residential purchases of £40,000 and more – add

3% to rates

Wales subsequently revised its Land Transaction Tax from 10 October 2022, raising the

threshold for residential buyers of its 0% band to £225,000 and increasing the tax rate in

the following band up to £400,000 to 6%. The higher bands remain unchanged, as do all

higher residential rate bands for non-residential buyers (e.g. buy to let investors). Any

changes to Scotland’s Land and Buildings Transaction Tax will be announced in the

Scottish Budget, to be published on 15 December.

Planning point

The increase in mortgage rates prompted by Mr Kwarteng’s fiscal event has brought

home the impact of earlier changes to the treatment of mortgage interest relief for

individual buy-to-let investors. Take, for example, a higher rate taxpaying buy-to-let

investor with a property producing £8,400 a year after expenses and a £200,000

mortgage originally fixed at 2% and due to reach the end of its term imminently. At

present, a new fixed rate mortgage for two years would cost about 5.0%.

Mortgage interest rate

2.00% 5.25%

Rental income after expenses £8,400 £8,400

Tax @ 40% -£3,360 -£3,360

Raymond James Budget Newsletter November 2022 9