Page 6 - Budget Newsletter November 2022

P. 6

National Insurance Contributions

The following NIC thresholds/limits will be frozen until 5 April 2028:

• The Class 1 Primary Threshold (employee), Upper Earnings Limit (employee),

Secondary Threshold (employer) and Upper Secondary Threshold (Employer).

• Class 2 Lower Profits Threshold (self-employed).

• The Class 4 Lower and Upper Profits Limits (self-employed).

The Lower Earnings Limit (£6,396 for employees) and small profits threshold (£6,725 for the

self-employed) will be unchanged in 2023/24.

For 2023/24, the Class 2 rate (self-employed) will rise to £3.45 per week and the Class 3

(Voluntary) rate will increase to £17.45 per week.

Previous announcements remaining in force

The NICs changes announced by Mr Kwarteng on 23 September were rapidly converted into

legislation and have now become law. These are:

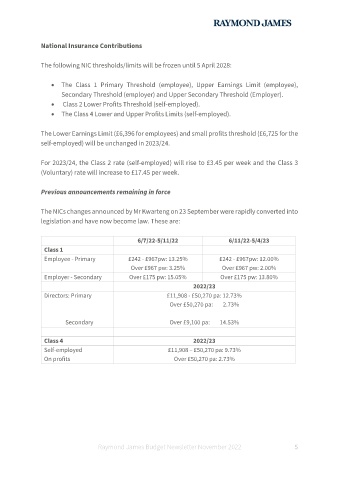

6/7/22-5/11/22 6/11/22-5/4/23

Class 1

Employee - Primary £242 - £967pw: 13.25% £242 - £967pw: 12.00%

Over £967 pw: 3.25% Over £967 pw: 2.00%

Employer - Secondary Over £175 pw: 15.05% Over £175 pw: 13.80%

2022/23

Directors: Primary £11,908 - £50,270 pa: 12.73%

Over £50,270 pa: 2.73%

Secondary Over £9,100 pa: 14.53%

Class 4 2022/23

Self-employed £11,908 – £50,270 pa: 9.73%

On profits Over £50,270 pa: 2.73%

Raymond James Budget Newsletter November 2022 5