Page 7 - Budget Newsletter November 2022

P. 7

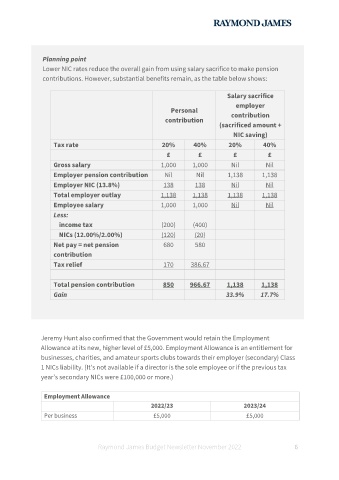

Planning point

Lower NIC rates reduce the overall gain from using salary sacrifice to make pension

contributions. However, substantial benefits remain, as the table below shows:

Salary sacrifice

employer

Personal contribution

contribution (sacrificed amount +

NIC saving)

Tax rate 20% 40% 20% 40%

£ £ £ £

Gross salary 1,000 1,000 Nil Nil

Employer pension contribution Nil Nil 1,138 1,138

Employer NIC (13.8%) 138 138 Nil Nil

Total employer outlay 1,138 1,138 1,138 1,138

Employee salary 1,000 1,000 Nil Nil

Less:

income tax (200) (400)

NICs (12.00%/2.00%) (120) (20)

Net pay = net pension 680 580

contribution

Tax relief 170 386.67

Total pension contribution 850 966.67 1,138 1,138

Gain 33.9% 17.7%

Jeremy Hunt also confirmed that the Government would retain the Employment

Allowance at its new, higher level of £5,000. Employment Allowance is an entitlement for

businesses, charities, and amateur sports clubs towards their employer (secondary) Class

1 NICs liability. (It’s not available if a director is the sole employee or if the previous tax

year’s secondary NICs were £100,000 or more.)

Employment Allowance

2022/23 2023/24

Per business £5,000 £5,000

Raymond James Budget Newsletter November 2022 6