Page 15 - Budget Newsletter November 2022

P. 15

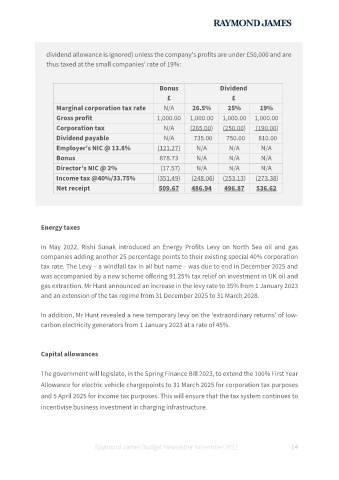

dividend allowance is ignored) unless the company’s profits are under £50,000 and are

thus taxed at the small companies’ rate of 19%:

Bonus Dividend

£ £

Marginal corporation tax rate N/A 26.5% 25% 19%

Gross profit 1,000.00 1,000.00 1,000.00 1,000.00

Corporation tax N/A (265.00) (250.00) (190.00)

Dividend payable N/A 735.00 750.00 810.00

Employer’s NIC @ 13.8% (121.27) N/A N/A N/A

Bonus 878.73 N/A N/A N/A

Director’s NIC @ 2% (17.57) N/A N/A N/A

Income tax @40%/33.75% (351.49) (248.06) (253.13) (273.38)

Net receipt 509.67 486.94 496.87 536.62

Energy taxes

In May 2022, Rishi Sunak introduced an Energy Profits Levy on North Sea oil and gas

companies adding another 25 percentage points to their existing special 40% corporation

tax rate. The Levy – a windfall tax in all but name – was due to end in December 2025 and

was accompanied by a new scheme offering 91.25% tax relief on investment in UK oil and

gas extraction. Mr Hunt announced an increase in the levy rate to 35% from 1 January 2023

and an extension of the tax regime from 31 December 2025 to 31 March 2028.

In addition, Mr Hunt revealed a new temporary levy on the ‘extraordinary returns’ of low-

carbon electricity generators from 1 January 2023 at a rate of 45%.

Capital allowances

The government will legislate, in the Spring Finance Bill 2023, to extend the 100% First Year

Allowance for electric vehicle chargepoints to 31 March 2025 for corporation tax purposes

and 5 April 2025 for income tax purposes. This will ensure that the tax system continues to

incentivise business investment in charging infrastructure.

Raymond James Budget Newsletter November 2022 14