Page 14 - Budget Newsletter November 2022

P. 14

• Crucially there would be an index-linked cap, initially set at £86,000, above which

an individual would not have to meet their personal care costs. So called ‘hotel

costs’, covering food and accommodation, would remain the individual’s

responsibility and would initially be set at a notional £200 a week.

The Act was passed in April of this year, but none of the all-important commencement

regulations have emerged. In September Mr Kwarteng scrapped the Health & Social Care

Levy which was to fund the new scheme, but gave no indication of any replacement

funding. Meanwhile English local authorities, which will continue to have a key role in

administering social care, have been asking for a delay of one or two years to prepare for

the new regime.

The Chancellor has decided to move out the implementation from the originally

announced date of October 2023 by two years. Although much of the media coverage has

been on the £86,000 cap, in the short term, the main savings the Treasury will make stem

from maintaining the current restrictive means testing rules.

Corporation tax

After a variety of changes and reversals in recent times, no new changes to the main rates

of corporation tax were announced.

Previous announcements remaining in force

The corporation tax increases announced and legislated for in 2021 by Rishi Sunak,

reversed by Mr Kwarteng and then reinstated by Liz Truss will now come into force as

originally planned from 1 April 2023:

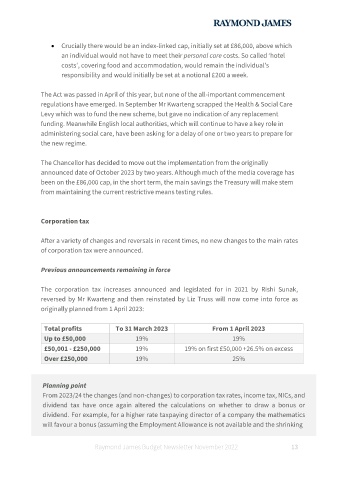

Total profits To 31 March 2023 From 1 April 2023

Up to £50,000 19% 19%

£50,001 - £250,000 19% 19% on first £50,000 +26.5% on excess

Over £250,000 19% 25%

Planning point

From 2023/24 the changes (and non-changes) to corporation tax rates, income tax, NICs, and

dividend tax have once again altered the calculations on whether to draw a bonus or

dividend. For example, for a higher rate taxpaying director of a company the mathematics

will favour a bonus (assuming the Employment Allowance is not available and the shrinking

Raymond James Budget Newsletter November 2022 13