Page 33 - Budget Newsletter - March 2023

P. 33

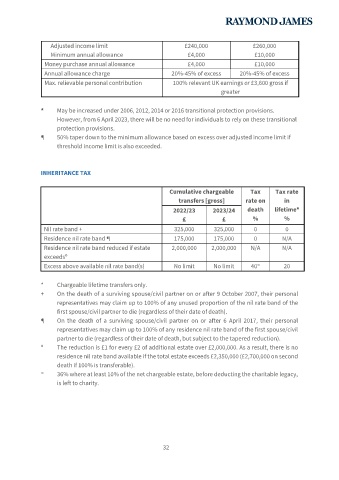

Adjusted income limit £240,000 £260,000

Minimum annual allowance £4,000 £10,000

Money purchase annual allowance £4,000 £10,000

Annual allowance charge 20%-45% of excess 20%-45% of excess

Max. relievable personal contribution 100% relevant UK earnings or £3,600 gross if

greater

* May be increased under 2006, 2012, 2014 or 2016 transitional protection provisions.

However, from 6 April 2023, there will be no need for individuals to rely on these transitional

protection provisions.

¶ 50% taper down to the minimum allowance based on excess over adjusted income limit if

threshold income limit is also exceeded.

INHERITANCE TAX

Cumulative chargeable Tax Tax rate

transfers [gross] rate on in

2022/23 2023/24 death lifetime*

£ £ % %

Nil rate band + 325,000 325,000 0 0

Residence nil rate band ¶ 175,000 175,000 0 N/A

Residence nil rate band reduced if estate 2,000,000 2,000,000 N/A N/A

exceedsº

Excess above available nil rate band(s) No limit No limit 40 20

∞

* Chargeable lifetime transfers only.

+ On the death of a surviving spouse/civil partner on or after 9 October 2007, their personal

representatives may claim up to 100% of any unused proportion of the nil rate band of the

first spouse/civil partner to die (regardless of their date of death).

¶ On the death of a surviving spouse/civil partner on or after 6 April 2017, their personal

representatives may claim up to 100% of any residence nil rate band of the first spouse/civil

partner to die (regardless of their date of death, but subject to the tapered reduction).

º The reduction is £1 for every £2 of additional estate over £2,000,000. As a result, there is no

residence nil rate band available if the total estate exceeds £2,350,000 (£2,700,000 on second

death if 100% is transferable).

∞ 36% where at least 10% of the net chargeable estate, before deducting the charitable legacy,

is left to charity.

32