Page 32 - Budget Newsletter - March 2023

P. 32

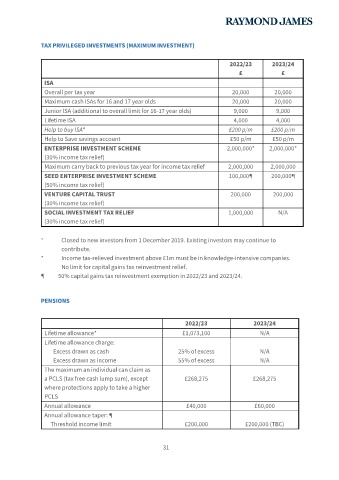

TAX PRIVILEGED INVESTMENTS (MAXIMUM INVESTMENT)

2022/23 2023/24

£ £

ISA

Overall per tax year 20,000 20,000

Maximum cash ISAs for 16 and 17 year olds 20,000 20,000

Junior ISA (additional to overall limit for 16-17 year olds) 9,000 9,000

Lifetime ISA 4,000 4,000

Help to buy ISA° £200 p/m £200 p/m

Help to Save savings account £50 p/m £50 p/m

ENTERPRISE INVESTMENT SCHEME 2,000,000* 2,000,000*

(30% income tax relief)

Maximum carry back to previous tax year for income tax relief 2,000,000 2,000,000

SEED ENTERPRISE INVESTMENT SCHEME 100,000¶ 200,000¶

(50% income tax relief)

VENTURE CAPITAL TRUST 200,000 200,000

(30% income tax relief)

SOCIAL INVESTMENT TAX RELIEF 1,000,000 N/A

(30% income tax relief)

° Closed to new investors from 1 December 2019. Existing investors may continue to

contribute.

* Income tax-relieved investment above £1m must be in knowledge-intensive companies.

No limit for capital gains tax reinvestment relief.

¶ 50% capital gains tax reinvestment exemption in 2022/23 and 2023/24.

PENSIONS

2022/23 2023/24

Lifetime allowance* £1,073,100 N/A

Lifetime allowance charge:

Excess drawn as cash 25% of excess N/A

Excess drawn as income 55% of excess N/A

The maximum an individual can claim as

a PCLS (tax free cash lump sum), except £268,275 £268,275

where protections apply to take a higher

PCLS

Annual allowance £40,000 £60,000

Annual allowance taper: ¶

Threshold income limit £200,000 £200,000 (TBC)

31