Page 29 - Budget Newsletter - March 2023

P. 29

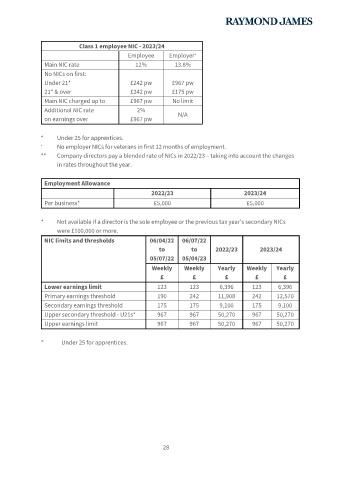

Class 1 employee NIC - 2023/24

Employee Employer

+

Main NIC rate 12% 13.8%

No NICs on first:

Under 21* £242 pw £967 pw

21* & over £242 pw £175 pw

Main NIC charged up to £967 pw No limit

Additional NIC rate 2%

on earnings over £967 pw N/A

* Under 25 for apprentices.

+ No employer NICs for veterans in first 12 months of employment.

** Company directors pay a blended rate of NICs in 2022/23 – taking into account the changes

in rates throughout the year.

Employment Allowance

2022/23 2023/24

Per business* £5,000 £5,000

* Not available if a director is the sole employee or the previous tax year’s secondary NICs

were £100,000 or more.

NIC limits and thresholds 06/04/22 06/07/22

to to 2022/23 2023/24

05/07/22 05/04/23

Weekly Weekly Yearly Weekly Yearly

£ £ £ £ £

Lower earnings limit 123 123 6,396 123 6,396

Primary earnings threshold 190 242 11,908 242 12,570

Secondary earnings threshold 175 175 9,100 175 9,100

Upper secondary threshold - U21s* 967 967 50,270 967 50,270

Upper earnings limit 967 967 50,270 967 50,270

* Under 25 for apprentices.

28