Page 28 - Budget Newsletter - March 2023

P. 28

° Up to the first £1,000 of gross income is generally taxed at the standard rate (unless more

trusts were created by the same settlor), i.e. 20% or 8.75% as appropriate.

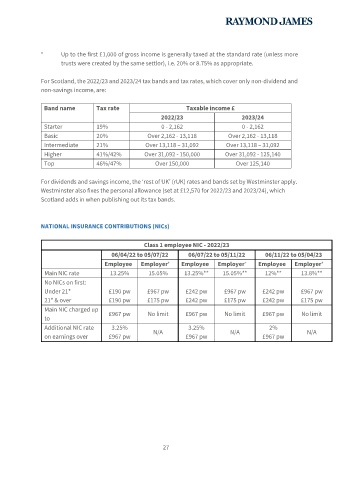

For Scotland, the 2022/23 and 2023/24 tax bands and tax rates, which cover only non-dividend and

non-savings income, are:

Band name Tax rate Taxable income £

2022/23 2023/24

Starter 19% 0 - 2,162 0 - 2,162

Basic 20% Over 2,162 - 13,118 Over 2,162 - 13,118

Intermediate 21% Over 13,118 – 31,092 Over 13,118 – 31,092

Higher 41%/42% Over 31,092 - 150,000 Over 31,092 - 125,140

Top 46%/47% Over 150,000 Over 125,140

For dividends and savings income, the ‘rest of UK’ (rUK) rates and bands set by Westminster apply.

Westminster also fixes the personal allowance (set at £12,570 for 2022/23 and 2023/24), which

Scotland adds in when publishing out its tax bands.

NATIONAL INSURANCE CONTRIBUTIONS (NICs)

Class 1 employee NIC - 2022/23

06/04/22 to 05/07/22 06/07/22 to 05/11/22 06/11/22 to 05/04/23

+

Employee Employer Employee Employer Employee Employer

+

+

Main NIC rate 13.25% 15.05% 13.25%** 15.05%** 12%** 13.8%**

No NICs on first:

Under 21* £190 pw £967 pw £242 pw £967 pw £242 pw £967 pw

21* & over £190 pw £175 pw £242 pw £175 pw £242 pw £175 pw

Main NIC charged up £967 pw No limit £967 pw No limit £967 pw No limit

to

Additional NIC rate 3.25% N/A 3.25% N/A 2% N/A

on earnings over £967 pw £967 pw £967 pw

27