Page 30 - Budget Newsletter - March 2023

P. 30

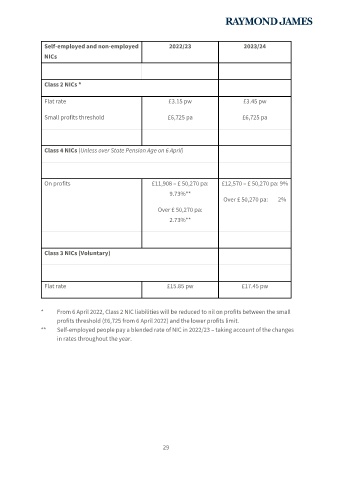

Self-employed and non-employed 2022/23 2023/24

NICs

Class 2 NICs *

Flat rate £3.15 pw £3.45 pw

Small profits threshold £6,725 pa £6,725 pa

Class 4 NICs (Unless over State Pension Age on 6 April)

On profits £11,908 – £ 50,270 pa: £12,570 – £ 50,270 pa: 9%

9.73%**

Over £ 50,270 pa: 2%

Over £ 50,270 pa:

2.73%**

Class 3 NICs (Voluntary)

Flat rate £15.85 pw £17.45 pw

* From 6 April 2022, Class 2 NIC liabilities will be reduced to nil on profits between the small

profits threshold (£6,725 from 6 April 2022) and the lower profits limit.

** Self-employed people pay a blended rate of NIC in 2022/23 – taking account of the changes

in rates throughout the year.

29