Page 36 - Budget Newsletter - March 2023

P. 36

* The special rate for unit trusts and OEICs will remain at 20% from 1 April 2023 as it is based

on the basic rate of income tax from 1 April 2023, which will also be remaining at 20%.

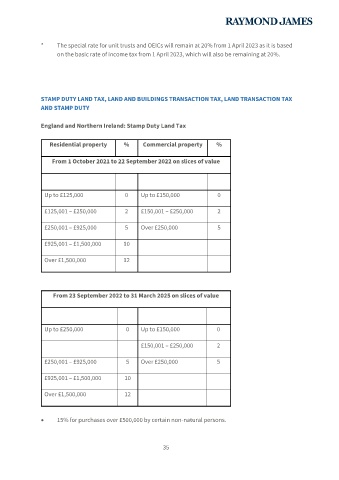

STAMP DUTY LAND TAX, LAND AND BUILDINGS TRANSACTION TAX, LAND TRANSACTION TAX

AND STAMP DUTY

England and Northern Ireland: Stamp Duty Land Tax

Residential property % Commercial property %

From 1 October 2021 to 22 September 2022 on slices of value

Up to £125,000 0 Up to £150,000 0

£125,001 – £250,000 2 £150,001 – £250,000 2

£250,001 – £925,000 5 Over £250,000 5

£925,001 – £1,500,000 10

Over £1,500,000 12

From 23 September 2022 to 31 March 2025 on slices of value

Up to £250,000 0 Up to £150,000 0

£150,001 – £250,000 2

£250,001 – £925,000 5 Over £250,000 5

£925,001 – £1,500,000 10

Over £1,500,000 12

• 15% for purchases over £500,000 by certain non-natural persons.

35