Page 19 - Budget Newsletter 2021

P. 19

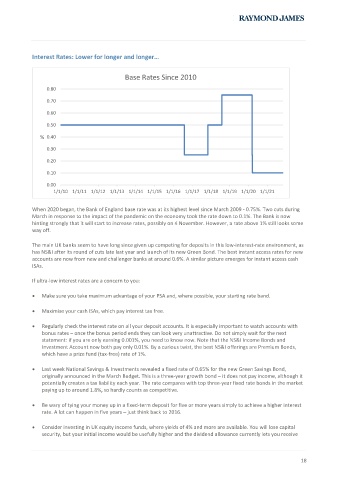

Interest Rates: Lower for longer and longer…

Base Rates Since 2010

0.80

0.70

0.60

0.50

% 0.40

0.30

0.20

0.10

0.00

1/1/10 1/1/11 1/1/12 1/1/13 1/1/14 1/1/15 1/1/16 1/1/17 1/1/18 1/1/19 1/1/20 1/1/21

When 2020 began, the Bank of England base rate was at its highest level since March 2009 - 0.75%. Two cuts during

March in response to the impact of the pandemic on the economy took the rate down to 0.1%. The Bank is now

hinting strongly that it will start to increase rates, possibly on 4 November. However, a rate above 1% still looks some

way off.

The main UK banks seem to have long since given up competing for deposits in this low-interest-rate environment, as

has NS&I after its round of cuts late last year and launch of its new Green Bond. The best instant access rates for new

accounts are now from new and challenger banks at around 0.6%. A similar picture emerges for instant access cash

ISAs.

If ultra-low interest rates are a concern to you:

• Make sure you take maximum advantage of your PSA and, where possible, your starting rate band.

• Maximise your cash ISAs, which pay interest tax free.

• Regularly check the interest rate on all your deposit accounts. It is especially important to watch accounts with

bonus rates – once the bonus period ends they can look very unattractive. Do not simply wait for the next

statement: if you are only earning 0.001%, you need to know now. Note that the NS&I Income Bonds and

Investment Account now both pay only 0.01%. By a curious twist, the best NS&I offerings are Premium Bonds,

which have a prize fund (tax-free) rate of 1%.

• Last week National Savings & Investments revealed a fixed rate of 0.65% for the new Green Savings Bond,

originally announced in the March Budget. This is a three-year growth bond – it does not pay income, although it

potentially creates a tax liability each year. The rate compares with top three-year fixed rate bonds in the market

paying up to around 1.8%, so hardly counts as competitive.

• Be wary of tying your money up in a fixed-term deposit for five or more years simply to achieve a higher interest

rate. A lot can happen in five years – just think back to 2016.

• Consider investing in UK equity income funds, where yields of 4% and more are available. You will lose capital

security, but your initial income would be usefully higher and the dividend allowance currently lets you receive

18