Page 24 - Budget Newsletter 2021

P. 24

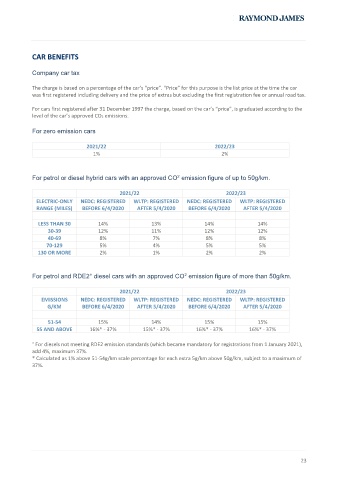

CAR BENEFITS

Company car tax

The charge is based on a percentage of the car’s “price”. “Price” for this purpose is the list price at the time the car

was first registered including delivery and the price of extras but excluding the first registration fee or annual road tax.

For cars first registered after 31 December 1997 the charge, based on the car’s “price”, is graduated according to the

level of the car’s approved CO2 emissions.

For zero emission cars

2021/22 2022/23

1% 2%

For petrol or diesel hybrid cars with an approved CO emission figure of up to 50g/km.

2

2021/22 2022/23

ELECTRIC-ONLY NEDC: REGISTERED WLTP: REGISTERED NEDC: REGISTERED WLTP: REGISTERED

RANGE (MILES) BEFORE 6/4/2020 AFTER 5/4/2020 BEFORE 6/4/2020 AFTER 5/4/2020

LESS THAN 30 14% 13% 14% 14%

30-39 12% 11% 12% 12%

40-69 8% 7% 8% 8%

70-129 5% 4% 5% 5%

130 OR MORE 2% 1% 2% 2%

For petrol and RDE2° diesel cars with an approved CO emission figure of more than 50g/km.

2

2021/22 2022/23

EMISSIONS NEDC: REGISTERED WLTP: REGISTERED NEDC: REGISTERED WLTP: REGISTERED

G/KM BEFORE 6/4/2020 AFTER 5/4/2020 BEFORE 6/4/2020 AFTER 5/4/2020

51-54 15% 14% 15% 15%

55 AND ABOVE 16%* - 37% 15%* - 37% 16%* - 37% 16%* - 37%

° For diesels not meeting RDE2 emission standards (which became mandatory for registrations from 1 January 2021),

add 4%, maximum 37%.

* Calculated as 1% above 51-54g/km scale percentage for each extra 5g/km above 50g/km, subject to a maximum of

37%.

23