Page 22 - Budget Newsletter 2021

P. 22

Facts & Figures

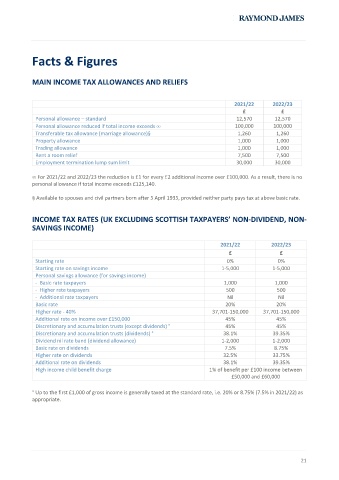

MAIN INCOME TAX ALLOWANCES AND RELIEFS

2021/22 2022/23

£ £

Personal allowance – standard 12,570 12,570

Personal allowance reduced if total income exceeds ∞ 100,000 100,000

Transferable tax allowance (marriage allowance)§ 1,260 1,260

Property allowance 1,000 1,000

Trading allowance 1,000 1,000

Rent a room relief 7,500 7,500

Employment termination lump sum limit 30,000 30,000

∞ For 2021/22 and 2022/23 the reduction is £1 for every £2 additional income over £100,000. As a result, there is no

personal allowance if total income exceeds £125,140.

§ Available to spouses and civil partners born after 5 April 1935, provided neither party pays tax at above basic rate.

INCOME TAX RATES (UK EXCLUDING SCOTTISH TAXPAYERS’ NON-DIVIDEND, NON-

SAVINGS INCOME)

2021/22 2022/23

£ £

Starting rate 0% 0%

Starting rate on savings income 1-5,000 1-5,000

Personal savings allowance (for savings income)

- Basic rate taxpayers 1,000 1,000

- Higher rate taxpayers 500 500

- Additional rate taxpayers Nil Nil

Basic rate 20% 20%

Higher rate - 40% 37,701-150,000 37,701-150,000

Additional rate on income over £150,000 45% 45%

Discretionary and accumulation trusts (except dividends) ° 45% 45%

Discretionary and accumulation trusts (dividends) ° 38.1% 39.35%

Dividend nil rate band (dividend allowance) 1-2,000 1-2,000

Basic rate on dividends 7.5% 8.75%

Higher rate on dividends 32.5% 33.75%

Additional rate on dividends 38.1% 39.35%

High income child benefit charge 1% of benefit per £100 income between

£50,000 and £60,000

° Up to the first £1,000 of gross income is generally taxed at the standard rate, i.e. 20% or 8.75% (7.5% in 2021/22) as

appropriate.

21