Page 23 - Budget Newsletter 2021

P. 23

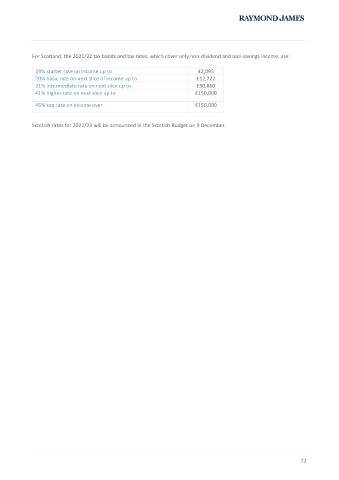

For Scotland, the 2021/22 tax bands and tax rates, which cover only non-dividend and non-savings income, are:

19% starter rate on income up to £2,095

20% basic rate on next slice of income up to £12,722

21% intermediate rate on next slice up to £30,860

41% higher rate on next slice up to £150,000

46% top rate on income over £150,000

Scottish rates for 2022/23 will be announced in the Scottish Budget on 9 December.

22