Page 17 - Budget Newsletter 2021

P. 17

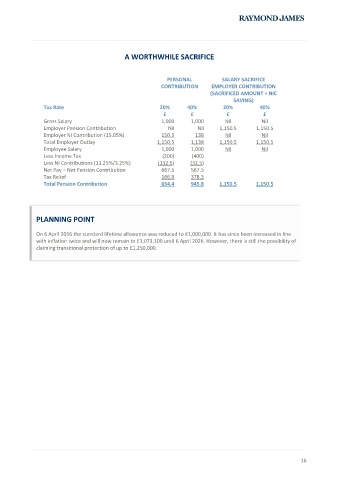

A WORTHWHILE SACRIFICE

PERSONAL SALARY SACRIFICE

CONTRIBUTION EMPLOYER CONTRIBUTION

(SACRIFICED AMOUNT + NIC

SAVING)

Tax Rate 20% 40% 20% 40%

£ £ £ £

Gross Salary 1,000 1,000 Nil Nil

Employer Pension Contribution Nil Nil 1,150.5 1,150.5

Employer NI Contribution (15.05%) 150.5 138 Nil Nil

Total Employer Outlay 1,150.5 1,138 1,150.5 1,150.5

Employee Salary 1,000 1,000 Nil Nil

Less Income Tax (200) (400)

Less NI Contributions (13.25%/3.25%) (132.5) (32.5)

Net Pay = Net Pension Contribution 667.5 567.5

Tax Relief 166.9 378.3

Total Pension Contribution 834.4 945.8 1,150.5 1,150.5

PLANNING POINT

On 6 April 2016 the standard lifetime allowance was reduced to £1,000,000. It has since been increased in line

with inflation twice and will now remain to £1,073,100 until 6 April 2026. However, there is still the possibility of

claiming transitional protection of up to £1,250,000.

16