Page 14 - Budget Newsletter 2021

P. 14

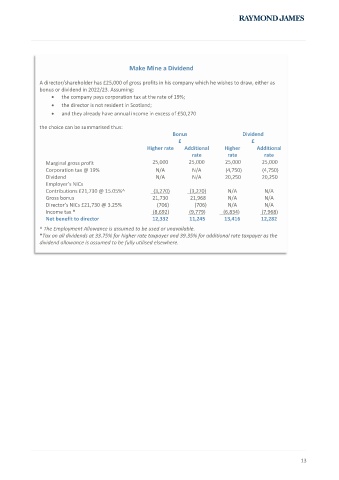

Make Mine a Dividend

A director/shareholder has £25,000 of gross profits in his company which he wishes to draw, either as

bonus or dividend in 2022/23. Assuming:

• the company pays corporation tax at the rate of 19%;

• the director is not resident in Scotland;

• and they already have annual income in excess of £50,270

the choice can be summarised thus:

Bonus Dividend

£ £

Higher rate Additional Higher Additional

rate rate rate

Marginal gross profit 25,000 25,000 25,000 25,000

Corporation tax @ 19% N/A N/A (4,750) (4,750)

Dividend N/A N/A 20,250 20,250

Employer’s NICs

Contributions £21,730 @ 15.05%^ (3,270) (3,270) N/A N/A

Gross bonus 21,730 21,968 N/A N/A

Director’s NICs £21,730 @ 3.25% (706) (706) N/A N/A

Income tax * (8,692) (9,779) (6,834) (7,968)

Net benefit to director 12,332 11,245 13,416 12,282

^ The Employment Allowance is assumed to be used or unavailable.

*Tax on all dividends at 33.75% for higher rate taxpayer and 39.35% for additional rate taxpayer as the

dividend allowance is assumed to be fully utilised elsewhere.

13