Page 29 - Budget Newsletter 2021

P. 29

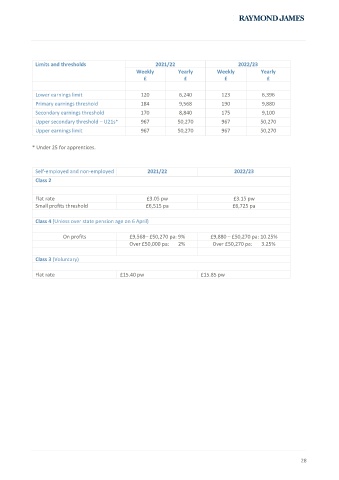

Limits and thresholds 2021/22 2022/23

Weekly Yearly Weekly Yearly

£ £ £ £

Lower earnings limit 120 6,240 123 6,396

Primary earnings threshold 184 9,568 190 9,880

Secondary earnings threshold 170 8,840 175 9,100

Upper secondary threshold – U21s* 967 50,270 967 50,270

Upper earnings limit 967 50,270 967 50,270

* Under 25 for apprentices.

Self-employed and non-employed 2021/22 2022/23

Class 2

Flat rate £3.05 pw £3.15 pw

Small profits threshold £6,515 pa £6,725 pa

Class 4 (Unless over state pension age on 6 April)

On profits £9,568– £50,270 pa: 9% £9,880 – £50,270 pa: 10.25%

Over £50,000 pa: 2% Over £50,270 pa: 3.25%

Class 3 (Voluntary)

Flat rate £15.40 pw £15.85 pw

28