Page 26 - Budget 2021

P. 26

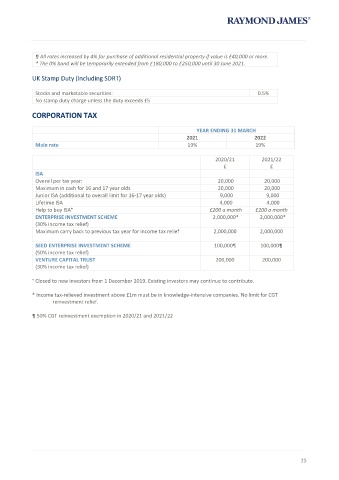

¶ All rates increased by 4% for purchase of additional residential property if value is £40,000 or more.

* The 0% band will be temporarily extended from £180,000 to £250,000 until 30 June 2021.

UK Stamp Duty (including SDRT)

Stocks and marketable securities: 0.5%

No stamp duty charge unless the duty exceeds £5

CORPORATION TAX

YEAR ENDING 31 MARCH

2021 2022

Main rate 19% 19%

2020/21 2021/22

£ £

ISA

Overall per tax year: 20,000 20,000

Maximum in cash for 16 and 17 year olds 20,000 20,000

Junior ISA (additional to overall limit for 16-17 year olds) 9,000 9,000

Lifetime ISA 4,000 4,000

Help to buy ISA° £200 a month £200 a month

ENTERPRISE INVESTMENT SCHEME 2,000,000* 2,000,000*

(30% income tax relief)

Maximum carry back to previous tax year for income tax relief 2,000,000 2,000,000

SEED ENTERPRISE INVESTMENT SCHEME 100,000¶ 100,000¶

(50% income tax relief)

VENTURE CAPITAL TRUST 200,000 200,000

(30% income tax relief)

° Closed to new investors from 1 December 2019. Existing investors may continue to contribute.

* Income tax-relieved investment above £1m must be in knowledge-intensive companies. No limit for CGT

reinvestment relief.

¶ 50% CGT reinvestment exemption in 2020/21 and 2021/22

25