Page 24 - Budget 2021

P. 24

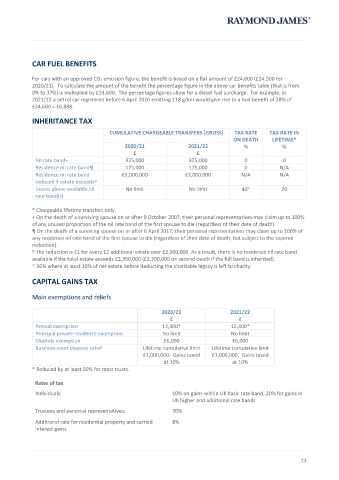

CAR FUEL BENEFITS

For cars with an approved CO2 emission figure, the benefit is based on a flat amount of £24,600 (£24,500 for

2020/21). To calculate the amount of the benefit the percentage figure in the above car benefits table (that is from

0% to 37%) is multiplied by £24,600. The percentage figures allow for a diesel fuel surcharge. For example, in

2021/22 a petrol car registered before 6 April 2020 emitting 118 g/km would give rise to a fuel benefit of 28% of

£24,600 = £6,888.

INHERITANCE TAX

CUMULATIVE CHARGEABLE TRANSFERS [GROSS] TAX RATE TAX RATE IN

ON DEATH LIFETIME*

2020/21 2021/22 % %

£ £

Nil rate band+ 325,000 325,000 0 0

Residence nil rate band¶ 175,000 175,000 0 N/A

Residence nil rate band £2,000,000 £2,000,000 N/A N/A

reduced if estate exceedsº

Excess above available nil No limit No limit 40 20

∞

rate band(s)

* Chargeable lifetime transfers only.

+ On the death of a surviving spouse on or after 9 October 2007, their personal representatives may claim up to 100%

of any unused proportion of the nil rate band of the first spouse to die (regardless of their date of death).

¶ On the death of a surviving spouse on or after 6 April 2017, their personal representatives may claim up to 100% of

any residence nil rate band of the first spouse to die (regardless of their date of death, but subject to the tapered

reduction).

º The reduction is £1 for every £2 additional estate over £2,000,000. As a result, there is no residence nil rate band

available if the total estate exceeds £2,350,000 (£2,700,000 on second death if the full band is inherited).

∞ 36% where at least 10% of net estate before deducting the charitable legacy is left to charity.

CAPITAL GAINS TAX

Main exemptions and reliefs

2020/21 2021/22

£ £

Annual exemption 12,300* 12,300*

Principal private residence exemption No limit No limit

Chattels exemption £6,000 £6,000

Business asset disposal relief Lifetime cumulative limit Lifetime cumulative limit

£1,000,000. Gains taxed £1,000,000. Gains taxed

at 10% at 10%

* Reduced by at least 50% for most trusts.

Rates of tax

Individuals: 10% on gains within UK basic rate band, 20% for gains in

UK higher and additional rate bands

Trustees and personal representatives: 20%

Additional rate for residential property and carried 8%

interest gains

23