Page 27 - Budget 2021

P. 27

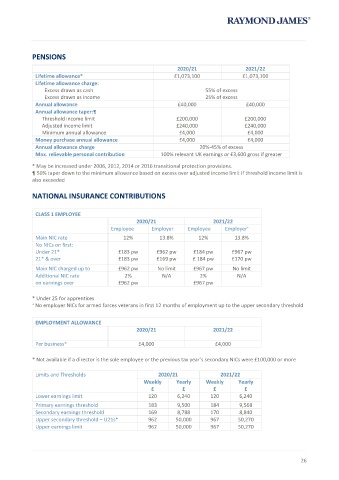

PENSIONS

2020/21 2021/22

Lifetime allowance* £1,073,100 £1,073,100

Lifetime allowance charge:

Excess drawn as cash 55% of excess

Excess drawn as income 25% of excess

Annual allowance £40,000 £40,000

Annual allowance taper:¶

Threshold income limit £200,000 £200,000

Adjusted income limit £240,000 £240,000

Minimum annual allowance £4,000 £4,000

Money purchase annual allowance £4,000 £4,000

Annual allowance charge 20%-45% of excess

Max. relievable personal contribution 100% relevant UK earnings or £3,600 gross if greater

* May be increased under 2006, 2012, 2014 or 2016 transitional protection provisions.

¶ 50% taper down to the minimum allowance based on excess over adjusted income limit if threshold income limit is

also exceeded

NATIONAL INSURANCE CONTRIBUTIONS

CLASS 1 EMPLOYEE

2020/21 2021/22

Employee Employer Employee Employer

+

Main NIC rate 12% 13.8% 12% 13.8%

No NICs on first:

Under 21* £183 pw £962 pw £184 pw £967 pw

21* & over £183 pw £169 pw £ 184 pw £170 pw

Main NIC charged up to £962 pw No limit £967 pw No limit

Additional NIC rate 2% N/A 2% N/A

on earnings over £962 pw £967 pw

* Under 25 for apprentices

+ No employer NICs for armed forces veterans in first 12 months of employment up to the upper secondary threshold

EMPLOYMENT ALLOWANCE

2020/21 2021/22

Per business* £4,000 £4,000

* Not available if a director is the sole employee or the previous tax year’s secondary NICs were £100,000 or more

Limits and Thresholds 2020/21 2021/22

Weekly Yearly Weekly Yearly

£ £ £ £

Lower earnings limit 120 6,240 120 6,240

Primary earnings threshold 183 9,500 184 9,568

Secondary earnings threshold 169 8,788 170 8,840

Upper secondary threshold – U21s* 962 50,000 967 50,270

Upper earnings limit 962 50,000 967 50,270

26