Page 25 - Budget 2021

P. 25

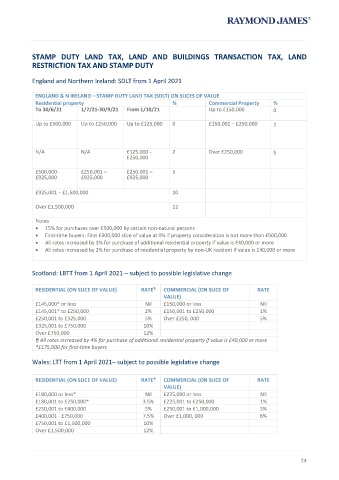

STAMP DUTY LAND TAX, LAND AND BUILDINGS TRANSACTION TAX, LAND

RESTRICTION TAX AND STAMP DUTY

England and Northern Ireland: SDLT from 1 April 2021

ENGLAND & N IRELAND – STAMP DUTY LAND TAX (SDLT) ON SLICES OF VALUE

Residential property % Commercial Property %

To 30/6/21 1/7/21-30/9/21 From 1/10/21 Up to £150,000 0

Up to £500,000 Up to £250,000 Up to £125,000 0 £150,001 – £250,000 2

N/A N/A £125,000 - 2 Over £250,000 5

£250,000

£500,000- £250,001 – £250,001 – 5

£925,000 £925,000 £925,000

£925,001 – £1,500,000 10

Over £1,500,000 12

Notes

• 15% for purchases over £500,000 by certain non-natural persons

• First-time buyers: First £300,000 slice of value at 0% if property consideration is not more than £500,000

• All rates increased by 3% for purchase of additional residential property if value is £40,000 or more

• All rates increased by 2% for purchase of residential property by non-UK resident if value is £40,000 or more

Scotland: LBTT from 1 April 2021 – subject to possible legislative change

RESIDENTIAL (ON SLICE OF VALUE) RATE COMMERCIAL (ON SLICE OF RATE

¶

VALUE)

£145,000* or less Nil £150,000 or less Nil

£145,001* to £250,000 2% £150,001 to £250,000 1%

£250,001 to £325,000 5% Over £250, 000 5%

£325,001 to £750,000 10%

Over £750,000 12%

¶ All rates increased by 4% for purchase of additional residential property if value is £40,000 or more

*£175,000 for first-time buyers

Wales: LTT from 1 April 2021– subject to possible legislative change

RESIDENTIAL (ON SLICE OF VALUE) RATE COMMERCIAL (ON SLICE OF RATE

¶

VALUE)

£180,000 or less* Nil £225,000 or less Nil

£180,001 to £250,000* 3.5% £225,001 to £250,000 1%

£250,001 to £400,000 5% £250,001 to £1,000,000 5%

£400,001 - £750,000 7.5% Over £1,000, 000 6%

£750,001 to £1,500,000 10%

Over £1,500,000 12%

24