Page 21 - Budget 2021

P. 21

Facts & Figures

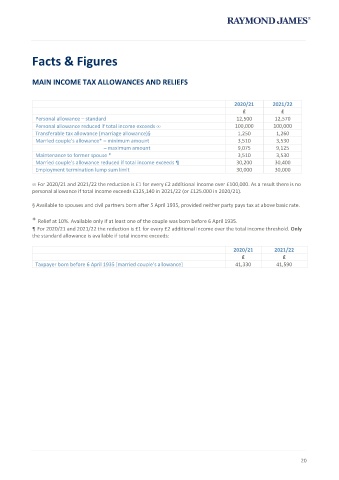

MAIN INCOME TAX ALLOWANCES AND RELIEFS

2020/21 2021/22

£ £

Personal allowance – standard 12,500 12,570

Personal allowance reduced if total income exceeds ∞ 100,000 100,000

Transferable tax allowance (marriage allowance)§ 1,250 1,260

Married couple’s allowance* – minimum amount 3,510 3,530

– maximum amount 9,075 9,125

Maintenance to former spouse * 3,510 3,530

Married couple’s allowance reduced if total income exceeds ¶ 30,200 30,400

Employment termination lump sum limit 30,000 30,000

∞ For 2020/21 and 2021/22 the reduction is £1 for every £2 additional income over £100,000. As a result there is no

personal allowance if total income exceeds £125,140 in 2021/22 (or £125.000 in 2020/21).

§ Available to spouses and civil partners born after 5 April 1935, provided neither party pays tax at above basic rate.

* Relief at 10%. Available only if at least one of the couple was born before 6 April 1935.

¶ For 2020/21 and 2021/22 the reduction is £1 for every £2 additional income over the total income threshold. Only

the standard allowance is available if total income exceeds:

2020/21 2021/22

£ £

Taxpayer born before 6 April 1935 [married couple’s allowance] 41,330 41,590

20