Page 18 - Budget 2021

P. 18

Retiree/At Retirement

The Pension Landscape in Spring 2021

There have been many changes to pensions in recent years, with another significant set of reforms having taken effect

in April 2016. These include:

• Three reductions in the standard lifetime allowance brought it down from £1.8m in 2011/12 to £1m for 2016/17.

This allowance effectively sets a tax-efficient ceiling for the value of pension benefits and, from April 2018, started

to rise annually in line with CPI inflation. However, that has now ceased, meaning the allowance will remain at

£1,073,100 until 6 April 2026.

• Further increases to State Pension Age (SPA), both legislated for and planned. For men and women, SPA reached

66 last year. The next step up to a SPA of 67 will start in April 2026.

• New rules, which have given much greater flexibility in drawing benefits from money purchase schemes, started

on 6 April 2015 and have encouraged many people to turn their entire pension pot into (mostly taxable) cash. The

new flexibility was accompanied by more generous tax treatment of death benefits, adding to the opportunities

that pensions offer for estate planning.

• The single-tier state pension started on 6 April 2016. If you are near to state pension age, it is worth checking

whether your National Insurance contribution record will gain you the maximum available.

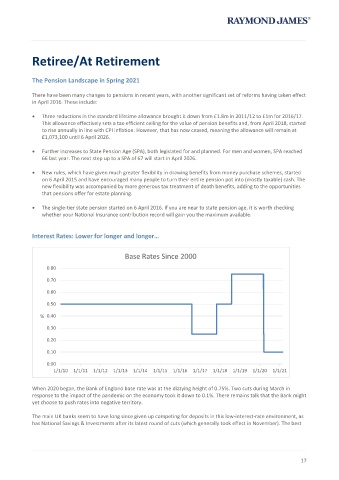

Interest Rates: Lower for longer and longer…

Base Rates Since 2000

0.80

0.70

0.60

0.50

% 0.40

0.30

0.20

0.10

0.00

1/1/10 1/1/11 1/1/12 1/1/13 1/1/14 1/1/15 1/1/16 1/1/17 1/1/18 1/1/19 1/1/20 1/1/21

When 2020 began, the Bank of England base rate was at the dizzying height of 0.75%. Two cuts during March in

response to the impact of the pandemic on the economy took it down to 0.1%. There remains talk that the Bank might

yet choose to push rates into negative territory.

The main UK banks seem to have long since given up competing for deposits in this low-interest-rate environment, as

has National Savings & Investments after its latest round of cuts (which generally took effect in November). The best

17