Page 13 - Budget 2021

P. 13

gave their contractors the choice of either transferring to PAYE employment, with the accompanying hit to their net

earnings, or leaving.

Importantly, the new rules do not apply to small companies, which in this context means that the company using a

contractor meets at least two of the following criteria:

• an annual turnover of not more than £10.2m;

• a balance sheet total of not more than £5.1m; and

• average number of employees of no more than 50.

Dividends or Salary...

Regular changes to National Insurance contributions and tax rates have altered the mathematics of the choice

between dividends and salary. For shareholder/directors able to choose between the two, and not caught by the ever-

tightening IR35 personal company rules (see above), a dividend remains the more efficient choice even if no dividend

allowance is left, as the example below shows. However, a pension contribution (within the annual allowance

provisions) could avoid all immediate tax and NIC costs.

The change in corporation tax from April 2023 will mean that the above table will need to be revised for companies

with profits of over £50,000.

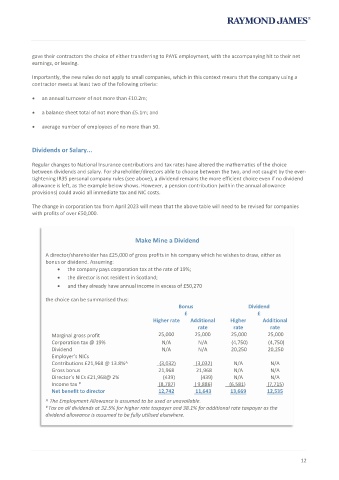

Make Mine a Dividend

A director/shareholder has £25,000 of gross profits in his company which he wishes to draw, either as

bonus or dividend. Assuming:

• the company pays corporation tax at the rate of 19%;

• the director is not resident in Scotland;

• and they already have annual income in excess of £50,270

the choice can be summarised thus:

Bonus Dividend

£ £

Higher rate Additional Higher Additional

rate rate rate

Marginal gross profit 25,000 25,000 25,000 25,000

Corporation tax @ 19% N/A N/A (4,750) (4,750)

Dividend N/A N/A 20,250 20,250

Employer’s NICs

Contributions £21,968 @ 13.8%^ (3,032) (3,032) N/A N/A

Gross bonus 21,968 21,968 N/A N/A

Director’s NICs £21,968@ 2% (439) (439) N/A N/A

Income tax * (8,787) ( 9,886) (6,581) (7,715)

Net benefit to director 12,742 11,643 13,669 12,535

^ The Employment Allowance is assumed to be used or unavailable.

*Tax on all dividends at 32.5% for higher rate taxpayer and 38.1% for additional rate taxpayer as the

dividend allowance is assumed to be fully utilised elsewhere.

12