Page 14 - ISQ Outlook 2023

P. 14

INVESTMENT STRATEGY QUARTERLY

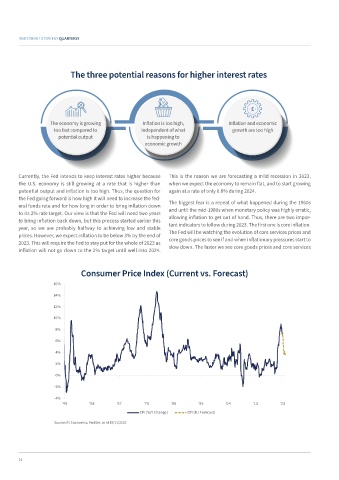

The three potential reasons for higher interest rates

The economy is growing Inflation is too high, Inflation and economic

too fast compared to independent of what growth are too high

potential output is happening to

economic growth

Currently, the Fed intends to keep interest rates higher because This is the reason we are forecasting a mild recession in 2023,

the U.S. economy is still growing at a rate that is higher than when we expect the economy to remain flat, and to start growing

potential output and inflation is too high. Thus, the question for again at a rate of only 0.8% during 2024.

the Fed going forward is how high it will need to increase the fed-

eral funds rate and for how long in order to bring inflation down The biggest fear is a repeat of what happened during the 1960s

to its 2% rate target. Our view is that the Fed will need two years and until the mid-1980s when monetary policy was highly erratic,

to bring inflation back down, but this process started earlier this allowing inflation to get out of hand. Thus, there are two impor-

year, so we are probably halfway to achieving low and stable tant indicators to follow during 2023. The first one is core inflation.

prices. However, we expect inflation to be below 3% by the end of The Fed will be watching the evolution of core services prices and

2023. This will require the Fed to stay put for the whole of 2023 as core goods prices to see if and when inflationary pressures start to

inflation will not go down to the 2% target until well into 2024. slow down. The faster we see core goods prices and core services

Consumer Price Index (Current vs. Forecast)

16%

14%

12%

10%

8%

6%

4%

2%

0%

-2%

-4%

'49 '58 '67 '76 '86 '95 '04 '13 '23

CPI (YoY Change) CPI (RJ Forecast)

Source: RJ Economics, FactSet, as of 19/11/2022

14