Page 13 - ISQ Outlook 2023

P. 13

INVESTMENT STRATEGY QUARTERLY

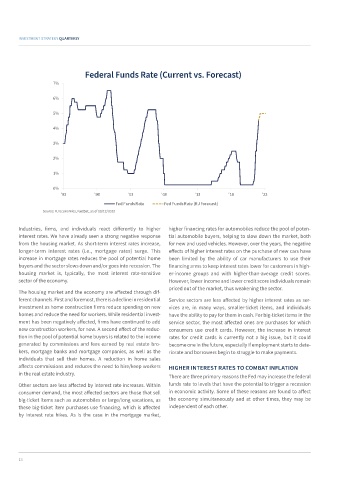

Federal Funds Rate (Current vs. Forecast)

7%

6%

7%

5%

6%

4% 5%

4%

3%

3%

2% 2%

1%

1%

0%

'93 '98 '03 '08 '13 '18 '23

0% Fed Funds Rate Fed Funds Rate (RJ Forecast)

'93 '98 '03 '08 '13 '18 '23

Fed Funds Rate Fed Funds Rate (RJ Forecast)

Source: RJ Economics, FactSet, as of 19/12/2022

Industries, firms, and individuals react differently to higher higher financing rates for automobiles reduce the pool of poten-

interest rates. We have already seen a strong negative response tial automobile buyers, helping to slow down the market, both

from the housing market. As short-term interest rates increase, for new and used vehicles. However, over the years, the negative

longer-term interest rates (i.e., mortgage rates) surge. This effects of higher interest rates on the purchase of new cars have

increase in mortgage rates reduces the pool of potential home been limited by the ability of car manufacturers to use their

buyers and the sector slows down and/or goes into recession. The financing arms to keep interest rates lower for customers in high-

housing market is, typically, the most interest rate-sensitive er-income groups and with higher-than-average credit scores.

sector of the economy. However, lower income and lower credit score individuals remain

priced out of the market, thus weakening the sector.

The housing market and the economy are affected through dif-

ferent channels. First and foremost, there is a decline in residential Service sectors are less affected by higher interest rates as ser-

investment as home construction firms reduce spending on new vices are, in many ways, smaller-ticket items, and individuals

homes and reduce the need for workers. While residential invest- have the ability to pay for them in cash. For big-ticket items in the

ment has been negatively affected, firms have continued to add service sector, the most affected ones are purchases for which

new construction workers, for now. A second effect of the reduc- consumers use credit cards. However, the increase in interest

tion in the pool of potential home buyers is related to the income rates for credit cards is currently not a big issue, but it could

generated by commissions and fees earned by real estate bro- become one in the future, especially if employment starts to dete-

kers, mortgage banks and mortgage companies, as well as the riorate and borrowers begin to struggle to make payments.

individuals that sell their homes. A reduction in home sales

affects commissions and reduces the need to hire/keep workers HIGHER INTEREST RATES TO COMBAT INFLATION

in the real estate industry.

There are three primary reasons the Fed may increase the federal

Other sectors are less affected by interest rate increases. Within funds rate to levels that have the potential to trigger a recession

consumer demand, the most affected sectors are those that sell in economic activity. Some of these reasons are found to affect

big-ticket items such as automobiles or large/long vacations, as the economy simultaneously and at other times, they may be

these big-ticket item purchases use financing, which is affected independent of each other.

by interest rate hikes. As is the case in the mortgage market,

13