Page 13 - ISQ UK Aprl 2020

P. 13

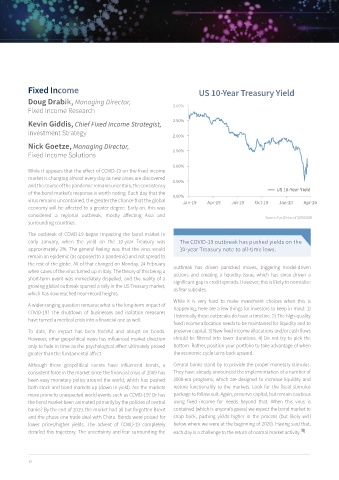

Fixed Income US 10-Year Treasury Yield

Doug Drabik, Managing Director,

Fixed Income Research 3.00%

Kevin Giddis, Chief Fixed Income Strategist, 2.50%

Investment Strategy

2.00%

Nick Goetze, Managing Director,

Fixed Income Solutions 1.50%

1.00%

While it appears that the effect of COVID-19 on the fixed income

market is changing almost every day as new cases are discovered 0.50%

and the course of the pandemic remains uncertain, the consistency

of the bond market’s response is worth noting. Each day that the US 10-Year Yield

0.00%

virus remains uncontained, the greater the chance that the global Jan-19 Apr-19 Jul-19 Oct-19 Jan-20 Apr-20

economy will be affected to a greater degree. Early on, this was

considered a regional outbreak, mostly affecting Asia and Source: FactSet as of 3/20/2020

surrounding countries.

The outbreak of COVID-19 began impacting the bond market in

early January, when the yield on the 10-year Treasury was The COVID-19 outbreak has pushed yields on the

approximately 2%. The general feeling was that the virus would 10-year Treasury note to all-time lows.

remain an epidemic (as opposed to a pandemic) and not spread to

the rest of the globe. All of that changed on Monday, 24 February outbreak has driven panicked moves, triggering model-driven

when cases of the virus turned up in Italy. The theory of this being a actions and creating a liquidity issue, which has since driven a

short-term event was immediately dispelled, and the reality of a significant gap in credit spreads. However, this is likely to normalise

growing global outbreak spurred a rally in the US Treasury market, as fear subsides.

which has now reached near-record heights.

While it is very hard to make investment choices when this is

A wider-ranging question remains: what is the long-term impact of happening, here are a few things for investors to keep in mind: 1)

COVID-19? The shutdown of businesses and isolation measures Historically these outbreaks do have a timeline. 2) The high-quality

have turned a medical crisis into a financial one as well.

fixed income allocation needs to be maintained for liquidity and to

To date, the impact has been forceful and abrupt on bonds. preserve capital. 3) New fixed income allocations and/or cash flows

However, other geopolitical news has influenced market direction should be filtered into lower durations. 4) Do not try to pick the

only to fade in time as the psychological affect ultimately proved bottom. Rather, position your portfolio to take advantage of when

greater than the fundamental affect. the economic cycle turns back upward.

Although these geopolitical events have influenced bonds, a Central banks stand by to provide the proper monetary stimulus.

consistent force in the market since the financial crisis of 2009 has They have already announced the implementation of a number of

been easy monetary policy around the world, which has pushed 2008-era programs, which are designed to increase liquidity and

both stock and bond markets up (down in yield). Are the markets restore functionality to the markets. Look for the fiscal stimulus

more prone to unexpected world events such as COVID-19? Or has package to follow suit. Again, preserve capital, but remain cautious

the bond market been animated primarily by the policies of central using fixed income for needs beyond that. When this virus is

banks? By the end of 2019, the market had all but forgotten Brexit contained (which is anyone’s guess) we expect the bond market to

and the phase one trade deal with China. Bonds were poised for snap back, pushing yields higher in the process (but likely well

lower prices/higher yields. The advent of COVID-19 completely below where we were at the beginning of 2020). Having said that,

derailed this trajectory. The uncertainty and fear surrounding the each day is a challenge to the return of normal market activity.

12 12