Page 9 - ISQ July 2022

P. 9

INVESTMENT STRATEGY QUARTERLY

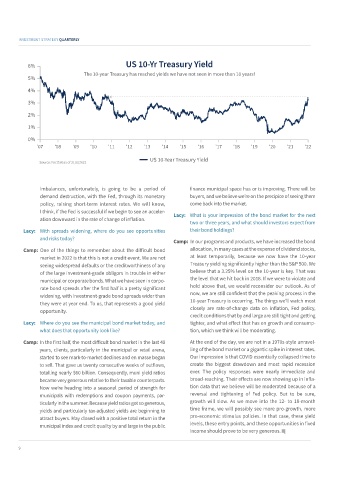

6% US 10-Yr Treasury Yield

The 10-year Treasury has reached yields we have not seen in more than 10 years!

5%

4%

3%

2%

1%

0%

'07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22

US 10-Year Treasury Yield

Source: FactSet as of 21/6/2022

imbalances, unfortunately, is going to be a period of finance municipal space has or is improving. There will be

demand destruction, with the Fed, through its monetary buyers, and we believe we’re on the precipice of seeing them

policy, raising short-term interest rates. We will know, come back into the market.

I think, if the Fed is successful if we begin to see an acceler- Lacy: What is your impression of the bond market for the next

ation downward in the rate of change of inflation.

two or three years, and what should investors expect from

Lacy: With spreads widening, where do you see opportunities their bond holdings?

and risks today?

Camp: In our programs and products, we have increased the bond

Camp: One of the things to remember about the difficult bond allocation, in many cases at the expense of dividend stocks,

market in 2022 is that this is not a credit event. We are not at least temporarily, because we now have the 10-year

seeing widespread defaults or the creditworthiness of any Treasury yielding significantly higher than the S&P 500. We

of the large investment-grade obligors in trouble in either believe that a 3.25% level on the 10-year is key. That was

municipal or corporate bonds. What we have seen in corpo- the level that we hit back in 2018. If we were to violate and

rate bond spreads after the first half is a pretty significant hold above that, we would reconsider our outlook. As of

widening, with investment-grade bond spreads wider than now, we are still confident that the peaking process in the

they were at year end. To us, that represents a good yield 10-year Treasury is occurring. The things we’ll watch most

opportunity. closely are rate-of-change data on inflation, Fed policy,

credit conditions that by and large are still tight and getting

Lacy: Where do you see the municipal bond market today, and tighter, and what effect that has on growth and consump-

what does that opportunity look like? tion, which we think will be moderating.

Camp: In the first half, the most difficult bond market in the last 40 At the end of the day, we are not in a 1970s-style unravel-

years, clients, particularly in the municipal or retail arena, ling of the bond market or a gigantic spike in interest rates.

started to see mark-to-market declines and en masse began Our impression is that COVID essentially collapsed time to

to sell. That gave us twenty consecutive weeks of outflows, create the biggest drawdown and most rapid recession

totalling nearly $60 billion. Consequently, muni yield ratios ever. The policy responses were nearly immediate and

became very generous relative to their taxable counterparts. broad-reaching. Their effects are now showing up in infla-

Now we’re heading into a seasonal period of strength for tion data that we believe will be moderated because of a

municipals with redemptions and coupon payments, par- reversal and tightening of Fed policy. But to be sure,

ticularly in the summer. Because yield ratios got so generous, growth will slow. As we move into the 12- to 18-month

yields and particularly tax-adjusted yields are beginning to time frame, we will possibly see more pro-growth, more

attract buyers. May closed with a positive total return in the pro-economic stimulus policies. In that case, these yield

municipal index and credit quality by and large in the public levels, these entry points, and these opportunities in fixed

income should prove to be very generous.

9