Page 12 - ISQ UK July 2020

P. 12

INVESTMENT STRATEGY QUARTERLY

Domestic vs. International Oil Prices

80

60

“

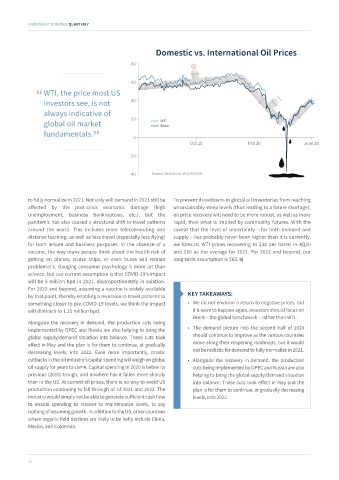

WTI, the price most US

investors see, is not 40

always indicative of

global oil market 20 WTI

Brent

fundamentals. ” 0

Oct 19 Feb 20 June 20

-20

-40 Source: FactSet as of 22/6/2020

to fully normalize in 2021. Not only will demand in 2021 still be To prevent drawdowns in global oil inventories from reaching

affected by the post-crisis economic damage (high unsustainably steep levels (thus leading to a future shortage),

unemployment, business bankruptcies, etc.), but the oil price recovery will need to be more robust, as well as more

pandemic has also caused a structural shift in travel patterns rapid, than what is implied by commodity futures. With the

around the world. This includes more telecommuting and caveat that the level of uncertainty – for both demand and

distance learning, as well as less travel (especially less flying) supply – has probably never been higher than it is currently,

for both leisure and business purposes. In the absence of a we forecast WTI prices recovering to $38 per barrel in 4Q20

vaccine, the way many people think about the health risk of and $50 as the average for 2021. For 2022 and beyond, our

getting on planes, cruise ships, or even buses will remain long-term assumption is $65.

problematic. Gauging consumer psychology is more art than

science, but our current assumption is that COVID-19’s impact

will be 5 million bpd in 2021, disproportionately in aviation.

For 2022 and beyond, assuming a vaccine is widely available

by that point, thereby enabling a reversion in travel patterns to KEY TAKEAWAYS:

something closer to pre-COVID-19 levels, we think the impact • We do not envision a return to negative prices, but

will diminish to 1.25 million bpd. if it were to happen again, investors should focus on

Brent – the global benchmark – rather than WTI.

Alongside the recovery in demand, the production cuts being

implemented by OPEC and Russia are also helping to bring the • The demand picture into the second half of 2020

global supply/demand situation into balance. These cuts took should continue to improve as the various countries

effect in May and the plan is for them to continue, at gradually move along their reopening roadmaps, but it would

decreasing levels, into 2022. Even more importantly, drastic not be realistic for demand to fully normalize in 2021.

cutbacks in the oil industry’s capital spending will weigh on global • Alongside the recovery in demand, the production

oil supply for years to come. Capital spending in 2020 is below its cuts being implemented by OPEC and Russia are also

previous (2016) trough, and nowhere has it fallen more sharply helping to bring the global supply/demand situation

than in the US. At current oil prices, there is no way to avoid US into balance. These cuts took effect in May and the

production continuing to fall through all of 2021 and 2022. The plan is for them to continue, at gradually decreasing

industry would simply not be able to generate sufficient cash flow levels, into 2022.

to enable spending to recover to maintenance levels, to say

nothing of resuming growth. In addition to the US, other countries

where organic field declines are likely to be hefty include China,

Mexico, and Colombia.

11