Page 7 - ISQ UK July 2020

P. 7

JULY 2020

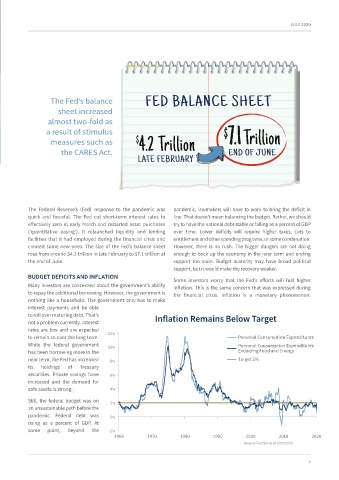

The Fed's balance FED BALANCE SHEET

sheet increased

almost two-fold as

a result of stimulus $ 7.1 Trillion

measures such as $ 4.2 Trillion

the CARES Act. END OF JUNE

LATE FEBRUARY

The Federal Reserve’s (Fed) response to the pandemic was pandemic, lawmakers will have to work to bring the deficit in

quick and forceful. The Fed cut short-term interest rates to line. That doesn’t mean balancing the budget. Rather, we should

effectively zero in early March and restarted asset purchases try to have the national debt stable or falling as a percent of GDP

(‘quantitative easing’). It relaunched liquidity and lending over time. Lower deficits will require higher taxes, cuts to

facilities that it had employed during the financial crisis and entitlement and other spending programs, or some combination.

created some new ones. The size of the Fed’s balance sheet However, there is no rush. The bigger dangers are not doing

rose from around $4.2 trillion in late February to $7.1 trillion at enough to back up the economy in the near term and ending

the end of June. support too soon. Budget austerity may have broad political

support, but it would make the recovery weaker.

BUDGET DEFICITS AND INFLATION Some investors worry that the Fed’s efforts will fuel higher

Many investors are concerned about the government’s ability inflation. This is the same concern that was expressed during

to repay the additional borrowing. However, the government is the financial crisis. Inflation is a monetary phenomenon.

nothing like a household. The government only has to make

interest payments and be able

to roll over maturing debt. That’s Inflation Remains Below Target

not a problem currently. Interest

rates are low and are expected

to remain so over the long term. 12% Personal Consumption Expenditures

While the federal government 10% Personal Consumption Expenditures

has been borrowing more in the Excluding Food and Energy

near term, the Fed has increased 8% Target 2%

its holdings of Treasury

securities. Private savings have 6%

increased and the demand for

safe assets is strong. 4%

Still, the federal budget was on 2%

an unsustainable path before the

pandemic. Federal debt was 0%

rising as a percent of GDP. At

some point, beyond the -2%

1960 1970 1980 1990 2000 2010 2020

Source: FactSet as of 29/5/2020

6