Page 7 - ISQ October 2022

P. 7

INVESTMENT STRATEGY QUARTERLY

YTD Foreign Currency Returns against the US dollar

Brazil

Mexico

Canadian Dollar

Swiss Franc

Indian Rupee

Australia Dollar

Chinese Yuan

Euro

Taiwan Dollar

British Pound

South Korean Won

Japanese Yen

-30.0% -25.0% -20.0% -15.0% -10.0% -5.0% 0.0% 5.0% 10.0%

Source: FactSet, as of 20/09/2022

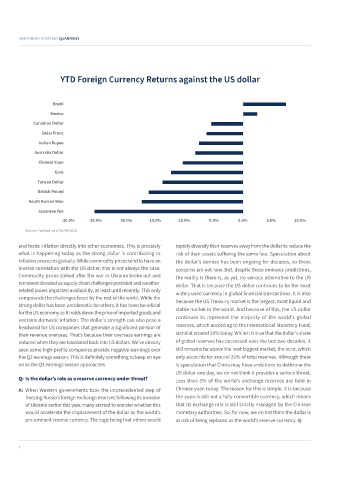

and feeds inflation directly into other economies. This is precisely rapidly diversify their reserves away from the dollar to reduce the

what is happening today as the strong dollar is contributing to risk of their assets suffering the same fate. Speculation about

inflation pressures globally. While commodity prices tend to have an the dollar’s demise has been ongoing for decades, so these

inverse correlation with the US dollar, this is not always the case. concerns are not new. But, despite these ominous predictions,

Commodity prices spiked after the war in Ukraine broke out and the reality is there is, as yet, no serious alternative to the US

remained elevated as supply chain challenges persisted and weather- dollar. That is because the US dollar continues to be the most

related issues impacted availability, at least until recently. This only widely used currency in global financial transactions. It is also

compounds the challenges faced by the rest of the world. While the

strong dollar has been problematic for others, it has been beneficial because the US Treasury market is the largest, most liquid and

for the US economy as it holds down the price of imported goods and stable market in the world. And because of this, the US dollar

restrains domestic inflation. The dollar’s strength can also pose a continues to represent the majority of the world’s global

headwind for US companies that generate a significant portion of reserves, which according to the International Monetary Fund,

their revenue overseas. That’s because their overseas earnings are stand at around 59% today. While it is true that the dollar’s share

reduced when they are translated back into US dollars. We’ve already of global reserves has decreased over the last two decades, it

seen some high-profile companies provide negative warnings over still remains far above the next biggest market, the euro, which

the Q2 earnings season. This is definitely something to keep an eye only accounts for around 20% of total reserves. Although there

on as the Q3 earnings season approaches. is speculation that China may have ambitions to dethrone the

US dollar one day, we do not think it provides a serious threat.

Q: Is the dollar’s role as a reserve currency under threat? Less than 3% of the world’s exchange reserves are held in

A: When Western governments took the unprecedented step of Chinese yuan today. The reason for this is simple. It is because

freezing Russia’s foreign exchange reserves following its invasion the yuan is still not a fully convertible currency, which means

of Ukraine earlier this year, many started to wonder whether this that its exchange rate is still strictly managed by the Chinese

would accelerate the displacement of the dollar as the world’s monetary authorities. So, for now, we do not think the dollar is

pre-eminent reserve currency. The logic being that others would at risk of being replaced as the world’s reserve currency.

7