Page 13 - ISQ October 2022

P. 13

INVESTMENT STRATEGY QUARTERLY

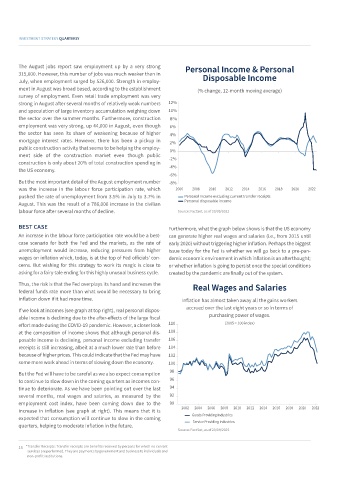

The August jobs report saw employment up by a very strong Personal Income & Personal

315,000. However, this number of jobs was much weaker than in Disposable Income

July, when employment surged by 526,000. Strength in employ-

ment in August was broad based, according to the establishment (% change, 12-month moving average)

survey of employment. Even retail trade employment was very

strong in August after several months of relatively weak numbers 12%

and speculation of large inventory accumulation weighing down 10%

the sector over the summer months. Furthermore, construction 8%

employment was very strong, up 44,000 in August, even though 6%

the sector has seen its share of weakening because of higher 4%

mortgage interest rates. However, there has been a pickup in 2%

public construction activity that seems to be helping the employ- 0%

ment side of the construction market even though public -2%

construction is only about 20% of total construction spending in

the US economy. -4%

-6%

But the most important detail of the August employment number -8%

was the increase in the labour force participation rate, which 2006 2008 2010 2012 2014 2016 2018 2020 2022

pushed the rate of unemployment from 3.5% in July to 3.7% in Personal Income excluding current transfer receipts

August. This was the result of a 786,000 increase in the civilian Personal disposable income

labour force after several months of decline. Source: FactSet, as of 20/09/2022

BEST CASE Furthermore, what the graph below shows is that the US economy

An increase in the labour force participation rate would be a best- can generate higher real wages and salaries (i.e., from 2015 until

case scenario for both the Fed and the markets, as the rate of early 2020) without triggering higher inflation. Perhaps the biggest

unemployment would increase, reducing pressures from higher issue today for the Fed is whether we will go back to a pre-pan-

wages on inflation which, today, is at the top of Fed officials’ con- demic economic environment in which inflation is an afterthought;

cerns. But wishing for this strategy to work its magic is close to or whether inflation is going to persist once the special conditions

asking for a fairy-tale ending for this highly unusual business cycle. created by the pandemic are finally out of the system.

Thus, the risk is that the Fed overplays its hand and increases the Real Wages and Salaries

federal funds rate more than what would be necessary to bring

inflation down if it had more time. Inflation has almost taken away all the gains workers

If we look at incomes (see graph at top right), real personal dispos- accrued over the last eight years or so in terms of

able income is declining due to the after-effects of the large fiscal purchasing power of wages.

effort made during the COVID-19 pandemic. However, a closer look 110 (2005 = 100 index)

at the composition of income shows that although personal dis- 108

posable income is declining, personal income excluding transfer 106

receipts is still increasing, albeit at a much lower rate than before 104

because of higher prices. This could indicate that the Fed may have 102

some more work ahead in terms of slowing down the economy. 100

But the Fed will have to be careful as we also expect consumption 98

to continue to slow down in the coming quarters as incomes con- 96

tinue to deteriorate. As we have been pointing out over the last 94

several months, real wages and salaries, as measured by the 92

employment cost index, have been coming down due to the 90

increase in inflation (see graph at right). This means that it is 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022

expected that consumption will continue to slow in the coming Goods Providing Industries

quarters, helping to moderate inflation in the future. Service Providing Industries

Source: FactSet, as of 20/09/2022

13 * Transfer Receipts: Transfer receipts are benefits received by persons for which no current

services are performed. They are payments by government and business to individuals and

non-profit institutions.