Page 18 - ISQ October 2022

P. 18

INVESTMENT STRATEGY QUARTERLY

Democrats pickup opportunities, as both states voted for Presi- Senate. In effect, the result of a split Congress following the mid-

dent Biden in 2020 and are currently seats held by Republicans. term elections may be the Goldilocks outcome for markets. With

Overall, the Senate should be viewed as a true battleground this this setup, any further threat of significant tax adjustments will be

fall, with prospects for its control likely coming down to individual off the table until 2025. Headline risk regarding budget/debt

race factors rather than serving as a referendum on the direction ceiling battles will also be less of a factor, as these fights are likely

of the country. to stay within Congress can be resolved there, rather than pit a

disunified Republican Congress against a Democratic White

IN SUMMARY, REPUBLICANS SEE FAVOURABLE House.

NATIONAL ENVIRONMENT, BUT DON’T DISCOUNT DEMS

While we view a scenario of Democrats controlling both the House

The overall trend in national political factors has been one of a and Senate in 2023 as the possibility with the lowest odds, this

Democratic recovery relative to the national environment seen would also be the scenario that would drive an out-sized market

earlier this year. The increased prominence of social issues, sus- reaction. Legislative risk driven by tax increases as part of the

tained labour market recovery, and the potential peak of inflation Democratic reconciliation and social policy agenda is now largely

(if the downward trend in domestic energy prices holds) alleviate viewed as a non-factor by the market given the current political

some of the pressure that has capped Democrats’ prospects. setup but would be poised for a resurgence on the off-chance that

While we continue to see material Republican gains (most likely in Democrats over-perform and maintain control of both chambers

the House), the likelihood is growing that the earlier forecasted of Congress. We caution that the electoral landscape will continue

‘Red Wave’ is dampened by a reinforced ‘Blue Wall’, particularly to be fluid up until the election, and that recent cycles have shown

when it comes to improved chances for Democrats to hold the that ‘unprecedented’ results cannot be fully discounted.

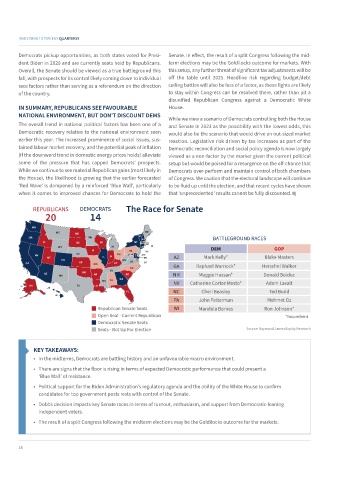

REPUBLICANS DEMOCRATS The Race for Senate

20 14

WA

WA

12

MT ME

MT 3 ND ME 4

OR 3 ND VT

VT

OR 7 MN BATTLEGROUND RACES

ID NY 3 NH

4 ID SD SD WI NY MA

29

WY 3

WY MI RI DEM GOP

3

NE IA PA NJ

NE 5 IN OH

NV UT IL IN DE AZ Mark Kelly* Blake Masters

6 UT IL 20 11 WV MD

CA CO KS MO KY WV 5 VA

KS

CA 6 MO KY 8 DC GA Raphael Warnock* Herschel Walker

55

10

TN NC

OK TN

11

AZ OK 7 AR SC NH Maggie Hassan* Donald Bolduc

AR

SC

NM 6 9

MS AL GA

MS 9 AL

6

AK LA NV Catherine Cortez Masto* Adam Laxalt

AK TX 8 LA

3

NC Cheri Beasley Ted Budd

FL

HI

PA John Fetterman Mehmet Oz

Republican Senate Seats WI Mandela Barnes Ron Johnson*

Open Seat - Current Republican *Incumbent

Democratic Senate Seats

Seats - Not Up For Election Source: Raymond James Equity Research

KEY TAKEAWAYS:

• In the midterms, Democrats are battling history and an unfavourable macro environment.

• There are signs that the floor is rising in terms of expected Democratic performance that could present a

‘Blue Wall’ of resistance.

• Political support for the Biden Administration’s regulatory agenda and the ability of the White House to confirm

candidates for top government posts rests with control of the Senate.

• Dobbs decision impacts key Senate races in terms of turnout, enthusiasm, and support from Democratic-leaning

independent voters.

• The result of a split Congress following the midterm elections may be the Goldilocks outcome for the markets.

18