Page 9 - ISQ UK_October 2021

P. 9

OCTOBER 2021

In a recession, the loss of jobs and income leads to reduced the economy has already recovered. Ideally, added spending should

spending, which leads to further job losses, and further reduc- be pulled back as private-sector demand recovers.

tions in spending, and so on. Fiscal stimulus is intended to halt

this snowballing and can be thought of as a bridge supporting The 2008 financial crisis and the pandemic both led to significant

aggregate demand while the private sector recovers. That bridge economic downturns, but they were different than typical reces-

should be long enough to get to the other side. Stimulus was mas- sions and very different from each other. Following the financial

sive following the 2008 financial crisis—the U.S. federal budget deficit crisis, it would take a long time to repair the damage to house-

rose to 10% of GDP. In hindsight, while it prevented a much more hold and business balance sheets. We tend to focus on federal

substantial downturn, it wasn’t large enough to propel the economy fiscal policy, but state policy played a key role in dampening the

to a full recovery right away. From the start, the Biden administration recovery. Most states have balanced budget requirements and

did not want to make the same mistake. state budgets turning red in the aftermath of the financial crisis

led to spending cuts. About a third of the $831 billion American

In every recession, U.S. lawmakers announce some sort of tax rebate. Recovery and Reinvestment Act of 2009 was aid to states, which

Economists caution that sending one-time checks to individuals isn’t limited job cuts initially, though state and local government

effective as these checks are more likely to be used to pay down debt employment still fell sharply and did not fully recovery until 2019.

or add to savings, and are less likely to be spent. However, as we saw State tax revenues appeared to be at risk in the early stages of the

during the pandemic, income support can provide a critical lifeline pandemic, but federal support helped the national economy to

for people who have lost jobs and income, and can prevent more recover, and most states saw a quick rebound in revenues. The

substantial economic weakening.

pandemic recession was the sharpest and briefest on record, but

Increased government spending is also used to fight recessions. Such brought massive job losses. The recovery has been swift, but par-

stimulus should be targeted, timely, and temporary. Large-scale

spending is difficult to plan quickly and, as we saw in the aftermath

of the 2008 crisis, there may not be shovel-ready projects. Getting the

money out rapidly is important. You don’t want to add stimulus after

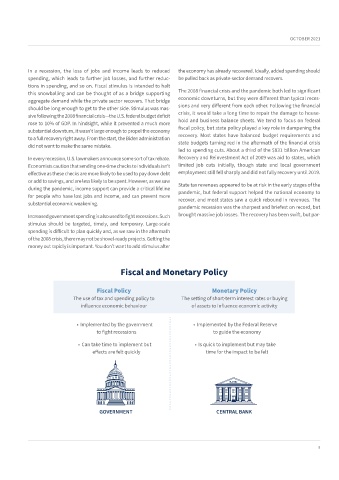

Fiscal and Monetary Policy

Fiscal Policy Monetary Policy

The use of tax and spending policy to The setting of short-term interest rates or buying

influence economic behaviour of assets to influence economic activity

• Implemented by the government • Implemented by the Federal Reserve

to fight recessions to guide the economy

• Can take time to implement but • Is quick to implement but may take

effects are felt quickly time for the impact to be felt

GOVERNMENT CENTRAL BANK

9