Page 10 - ISQ UK_October 2021

P. 10

INVESTMENT STRATEGY QUARTERLY

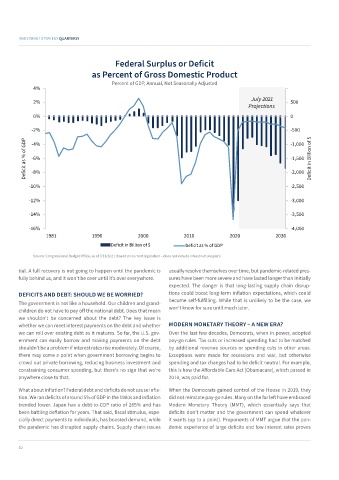

Federal Surplus or Deficit

as Percent of Gross Domestic Product

Percent of GDP, Annual, Not Seasonally Adjusted

4%

2% July 2021 500

Projections

0% 0

-2% -500

Deficit as % of GDP -6% -1,500 Deficit in Billion of $

-4%

-1,000

-2,000

-8%

-10% -2,500

-12% -3,000

-14% -3,500

-16% -4,000

Deficit in Billion of $ Deficit as % of GDP

Source: Congressional Budget Office, as of 7/31/2021 (based on current legislation – does not include infrastructure plan)

tial. A full recovery is not going to happen until the pandemic is usually resolve themselves over time, but pandemic-related pres-

fully behind us, and it won’t be over until it’s over everywhere. sures have been more severe and have lasted longer than initially

expected. The danger is that long-lasting supply chain disrup-

DEFICITS AND DEBT: SHOULD WE BE WORRIED? tions could boost long-term inflation expectations, which could

The government is not like a household. Our children and grand- become self-fulfilling. While that is unlikely to be the case, we

children do not have to pay off the national debt. Does that mean won’t know for sure until much later.

we shouldn’t be concerned about the debt? The key issue is

whether we can meet interest payments on the debt and whether MODERN MONETARY THEORY – A NEW ERA?

we can roll over existing debt as it matures. So far, the U.S. gov- Over the last few decades, Democrats, when in power, adopted

ernment can easily borrow and making payments on the debt pay-go rules. Tax cuts or increased spending had to be matched

shouldn’t be a problem if interest rates rise moderately. Of course, by additional revenue sources or spending cuts in other areas.

there may come a point when government borrowing begins to Exceptions were made for recessions and war, but otherwise

crowd out private borrowing, reducing business investment and spending and tax changes had to be deficit neutral. For example,

constraining consumer spending, but there’s no sign that we’re this is how the Affordable Care Act (Obamacare), which passed in

anywhere close to that. 2010, was paid for.

What about inflation? Federal debt and deficits do not cause infla- When the Democrats gained control of the House in 2019, they

tion. We ran deficits of around 5% of GDP in the 1980s and inflation did not reinstate pay-go rules. Many on the far left have embraced

trended lower. Japan has a debt-to-GDP ratio of 265% and has Modern Monetary Theory (MMT), which essentially says that

been battling deflation for years. That said, fiscal stimulus, espe- deficits don’t matter and the government can spend whatever

cially direct payments to individuals, has boosted demand, while it wants (up to a point). Proponents of MMT argue that the pan-

the pandemic has disrupted supply chains. Supply chain issues demic experience of large deficits and low interest rates proves

10