Page 8 - ISQ July 2021

P. 8

INVESTMENT STRATEGY QUARTERLY

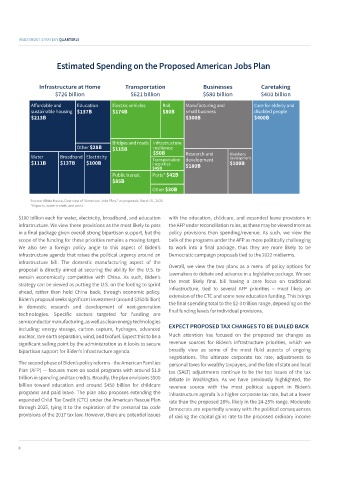

Estimated Spending on the Proposed American Jobs Plan

Infrastructure at Home Transportation Businesses Caretaking

$726 billion $621 billion $580 billion $400 billion

Affordable and Education Electric vehicles Rail Manufacturing and Care for elderly and

sustainable housing $137B $174B $80B small business disabled people

$213B $300B $400B

Bridges and roads Infrastructure

Other $28B $115B resilience

Water Broadband Electricity $50B Research and Workforce

development

$111B $137B $100B Transportation development $100B

inequities

$45B $180B

Public transit Ports* $42B

$85B

Other $30B

Source: White House, Overview of “American Jobs Plan,” as proposed, March 31, 2021

*Airports, water transit, and ports

$100 billion each for water, electricity, broadband, and education with the education, childcare, and expanded leave provisions in

infrastructure. We view these provisions as the most likely to pass the AFP under reconciliation rules, as these may be viewed more as

in a final package given overall strong bipartisan support, but the policy provisions than spending/revenue. As such, we view the

scope of the funding for these priorities remains a moving target. bulk of the programs under the AFP as more politically challenging

We also see a foreign policy angle to this aspect of Biden’s to work into a final package, thus they are more likely to be

infrastructure agenda that raises the political urgency around an Democratic campaign proposals tied to the 2022 midterms.

infrastructure bill. The domestic manufacturing aspect of the

proposal is directly aimed at securing the ability for the U.S. to Overall, we view the two plans as a menu of policy options for

remain economically competitive with China. As such, Biden’s lawmakers to debate and advance in a legislative package. We see

strategy can be viewed as putting the U.S. on the footing to sprint the most likely final bill having a core focus on traditional

ahead, rather than hold China back, through economic policy. infrastructure, tied to several AFP priorities – most likely an

Biden’s proposal seeks significant investment (around $250 billion) extension of the CTC and some new education funding. This brings

in domestic research and development of next-generation the final spending total to the $2-3 trillion range, depending on the

technologies. Specific sectors targeted for funding are final funding levels for individual provisions.

semiconductor manufacturing, as well as clean energy technologies

including: energy storage, carbon capture, hydrogen, advanced EXPECT PROPOSED TAX CHANGES TO BE DIALED BACK

nuclear, rare earth separation, wind, and biofuel. Expect this to be a Much attention has focused on the proposed tax changes as

significant selling point by the administration as it looks to secure revenue sources for Biden’s infrastructure priorities, which we

bipartisan support for Biden’s infrastructure agenda. broadly view as some of the most fluid aspects of ongoing

negotiations. The ultimate corporate tax rate, adjustments to

The second phase of Biden’s policy reforms - the American Families personal taxes for wealthy taxpayers, and the fate of state and local

Plan (AFP) — focuses more on social programs with around $1.8 tax (SALT) adjustments continue to be the top issues of the tax

trillion in spending and tax credits. Broadly, the plan envisions $500 debate in Washington. As we have previously highlighted, the

billion toward education and around $450 billion for childcare revenue source with the most political support in Biden’s

programs and paid leave. The plan also proposes extending the infrastructure agenda is a higher corporate tax rate, but at a lower

expanded Child Tax Credit (CTC) under the American Rescue Plan rate than the proposed 28%, likely in the 24-25% range. Moderate

through 2025, tying it to the expiration of the personal tax code Democrats are reportedly uneasy with the political consequences

provisions of the 2017 tax law. However, there are potential issues of raising the capital gains rate to the proposed ordinary income

8