Page 5 - ISQ July 2021

P. 5

JULY 2021

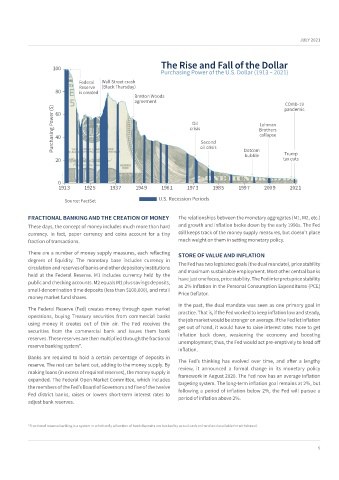

The Rise and Fall of the Dollar

100

Purchasing Power of the U.S. Dollar (1913 – 2021)

Federal Wall Street crash

Reserve (Black Thursday)

80 is created

Bretton Woods

agreement pandemic

COVID-19

Purchasing Power ($) 40 crisis Second Brothers

60

Oil

Lehman

collapse

oil crisis

Dotcom

bubble Trump

20 tax cuts

0

1913 1925 1937 1949 1961 1973 1985 1997 2009 2021

Source: FactSet U.S. Recession Periods

FRACTIONAL BANKING AND THE CREATION OF MONEY The relationships between the monetary aggregates (M1, M2, etc.)

These days, the concept of money includes much more than hard and growth and inflation broke down by the early 1990s. The Fed

currency. In fact, paper currency and coins account for a tiny still keeps track of the money supply measures, but doesn’t place

fraction of transactions. much weight on them in setting monetary policy.

There are a number of money supply measures, each reflecting STORE OF VALUE AND INFLATION

degrees of liquidity. The monetary base includes currency in

circulation and reserves of banks and other depository institutions The Fed has two legislated goals (the dual mandate), price stability

held at the Federal Reserve. M1 includes currency held by the and maximum sustainable employment. Most other central banks

public and checking accounts. M2 equals M1 plus savings deposits, have just one focus, price stability. The Fed interprets price stability

small-denomination time deposits (less than $100,000), and retail as 2% inflation in the Personal Consumption Expenditures (PCE)

money market fund shares. Price Deflator.

In the past, the dual mandate was seen as one primary goal in

The Federal Reserve (Fed) creates money through open market practice. That is, if the Fed worked to keep inflation low and steady,

operations, buying Treasury securities from commercial banks the job market would be stronger on average. If the Fed let inflation

using money it creates out of thin air. The Fed receives the get out of hand, it would have to raise interest rates more to get

securities from the commercial bank and issues them bank inflation back down, weakening the economy and boosting

reserves. These reserves are then multiplied through the fractional unemployment; thus, the Fed would act pre-emptively to head off

reserve banking system*.

inflation.

Banks are required to hold a certain percentage of deposits in The Fed’s thinking has evolved over time, and after a lengthy

reserve. The rest can be lent out, adding to the money supply. By review, it announced a formal change in its monetary policy

making loans (in excess of required reserves), the money supply is framework in August 2020. The Fed now has an average inflation

expanded. The Federal Open Market Committee, which includes targeting system. The long-term inflation goal remains at 2%, but

the members of the Fed’s Board of Governors and five of the twelve following a period of inflation below 2%, the Fed will pursue a

Fed district banks, raises or lowers short-term interest rates to period of inflation above 2%.

adjust bank reserves.

*Fractional reserve banking is a system in which only a fraction of bank deposits are backed by actual cash on hand and available for withdrawal.

5