Page 15 - ISO April 2023

P. 15

INVESTMENT STRATEGY QUARTERLY

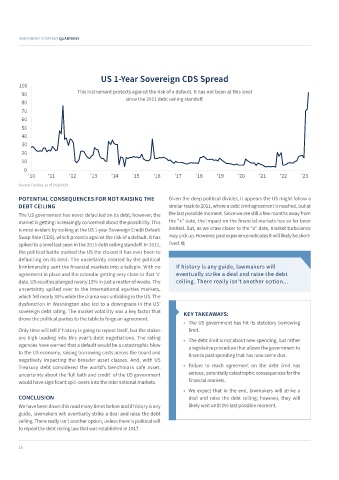

US 1-Year Sovereign CDS Spread

100

90 This instrument protects against the risk of a default. It has not been at this level

80 since the 2011 debt ceiling standoff.

70

60

50

40

30

20

10

0

'10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23

Source: FactSet, as of 17/3/2023

POTENTIAL CONSEQUENCES FOR NOT RAISING THE Given the deep political divides, it appears the US might follow a

DEBT CEILING similar track to 2011, where a debt limit agreement is reached, but at

The US government has never defaulted on its debt; however, the the last possible moment. Since we are still a few months away from

market is getting increasingly concerned about the possibility. This the “x” date, the impact on the financial markets has so far been

is most evident by looking at the US 1-year Sovereign Credit Default limited. But, as we draw closer to the “x” date, market turbulence

Swap Rate (CDS), which protects against the risk of a default. It has may pick up. However, past experience indicates it will likely be short-

spiked to a level last seen in the 2011 debt ceiling standoff. In 2011, lived.

the political battle pushed the US the closest it has ever been to

defaulting on its debt. The uncertainty created by the political

brinkmanship sent the financial markets into a tailspin. With no If history is any guide, lawmakers will

agreement in place and the calendar getting very close to that ‘x’ eventually strike a deal and raise the debt

date, US equities plunged nearly 15% in just a matter of weeks. The ceiling. There really isn’t another option...

uncertainty spilled over to the international equities markets,

which fell nearly 30% while the drama was unfolding in the US. The

dysfunction in Washington also led to a downgrade in the US’

sovereign debt rating. The market volatility was a key factor that KEY TAKEAWAYS:

drove the political parties to the table to forge an agreement.

• The US government has hit its statutory borrowing

Only time will tell if history is going to repeat itself, but the stakes limit.

are high leading into this year’s debt negotiations. The rating • The debt limit is not about new spending, but rather

agencies have warned that a default would be a catastrophic blow a legislative procedure that allows the government to

to the US economy, raising borrowing costs across the board and finance past spending that has now come due.

negatively impacting the broader asset classes. And, with US

Treasury debt considered the world’s benchmark safe asset, • Failure to reach agreement on the debt limit has

uncertainty about the ‘full faith and credit’ of the US government serious, potentially catastrophic consequences for the

would have significant spill-overs into the international markets. financial markets.

• We expect that in the end, lawmakers will strike a

CONCLUSION deal and raise the debt ceiling; however, they will

We have been down this road many times before and if history is any likely wait until the last possible moment.

guide, lawmakers will eventually strike a deal and raise the debt

ceiling. There really isn’t another option, unless there is political will

to repeal the debt ceiling law that was established in 1917.

15