Page 14 - ISO April 2023

P. 14

INVESTMENT STRATEGY QUARTERLY

WHAT IS THE DEBT CEILING?

The origins of the debt ceiling can be traced back to 1917 when

the US was in the midst of World War I. The new law was initially The debt limit is not about new spending, but

created to simplify the process of issuing debt to fund war rather a legislative procedure that allows the

operations. In 1939, Congress established an aggregate debt limit, government to finance past spending that has

which has been routinely increased or suspended over the years. now come due.

Since the 1960s the debt ceiling has been raised 78 times. The

purpose of the debt ceiling is to establish a maximum amount of Jerome Powell and other high-profile economists about the

debt the US government can have outstanding. Once the limit has potential consequences of not raising the debt limit have thus

been hit, the federal government cannot increase the amount of far been ignored. The White House refuses to negotiate as it

outstanding debt until Congress authorises a new debt limit or wants to pass a clean debt limit increase—that is, not tying an

suspends it for a period of time. Adjusting the debt ceiling has increase in the debt limit to the current budgetary process. This

historically been a routine matter that did not garner much media is a key point as raising the debt limit is not about new spending,

attention or rattle the markets; however, in recent years it has but rather a legislative procedure that allows the government to

turned into a political hot button. The most notable confrontation, finance past spending that has now come due. With neither

which pushed the US close to the brink of default, occurred in party showing a willingness to negotiate or budge from their

2011. Past debt-limit showdowns have typically occurred when positions, it appears likely that the US is heading for another

there is a Democrat in the White House and Republicans have showdown in the months ahead. This is important because as

control of Congress. the country gets closer to the ‘x’ date—the date the US

government would officially run out of money—the closer the US

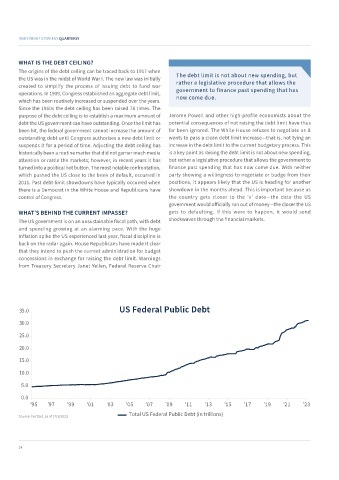

WHAT’S BEHIND THE CURRENT IMPASSE? gets to defaulting. If this were to happen, it would send

The US government is on an unsustainable fiscal path, with debt shockwaves through the financial markets.

and spending growing at an alarming pace. With the huge

inflation spike the US experienced last year, fiscal discipline is

back on the radar again. House Republicans have made it clear

that they intend to push the current administration for budget

concessions in exchange for raising the debt limit. Warnings

from Treasury Secretary Janet Yellen, Federal Reserve Chair

35.0 US Federal Public Debt

30.0

25.0

20.0

15.0

10.0

5.0

0.0

'95 '97 '99 '01 '03 '05 '07 '09 '11 '13 '15 '17 '19 '21 '23

Total US Federal Public Debt (in trillions)

Source: FactSet, as of 17/3/2023

14