Page 18 - ISQ UK_October 2017

P. 18

INVESTMENT STRATEGY QUARTERLY

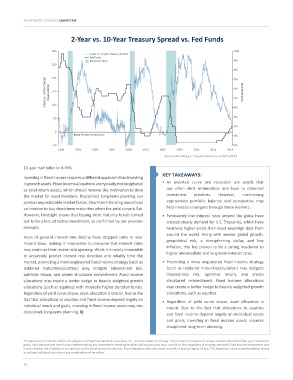

2-Year vs. 10-Year Treasury Spread vs. Fed Funds

300 10%

2 year vs. 10 year Treasury Spread

Fed Funds

Recession Years 9%

250

8%

200

2-Year vs. 10-Year Spread (basis points) 150 6% Fed Funds Rate

7%

5%

100

3%

50 4%

2%

0

Below “0” Axis: Inverted Curve 1%

-50 0%

1988 1991 1994 1997 2000 2003 2006 2009 2012 2015 2018

Source: Bloomberg LP; Raymond James as of 09/15/2018

10-year had fallen to 4.76%.

KEY TAKEAWAYS:

Investing in fixed income requires a different approach than investing

in growth assets. Fixed income allocations are typically not designated • An inverted curve and recession are words that

as total return assets, which should remove the motivation to time can often elicit intimidation and lead to distorted

the market for most investors. Disciplined, long-term planning can investment practices. However, maintaining

combat unpredictable market forces. Short-term thinking would lead appropriate portfolio balance and perspective may

an investor to buy short-term maturities when the yield curve is flat. help investors navigate through these markets.

However, hindsight shows that buying short maturity bonds turned • Persistently low interest rates around the globe have

out to be a less attractive investment, as confirmed by our previous created steady demand for U.S. Treasuries, which have

example. relatively higher yields than most sovereign debt from

around the world. Along with weaker global growth,

Years of general interest rate decline have dropped rates to near

historic lows, making it reasonable to presume that interest rates geopolitical risk, a strengthening dollar, and low

may continue their recent mild upswing. While it is nearly impossible inflation, this has proven to be a strong headwind to

to accurately predict interest rate direction and reliably time the higher intermediate and long-term interest rates.

market, promoting a more engineered fixed income strategy (such as • Promoting a more engineered fixed income strategy

laddered maturities/duration) may mitigate interest-rate risk, (such as laddered maturities/duration) may mitigate

optimize return, and create structured reinvestment. Fixed income interest-rate risk, optimise return, and create

allocations may create a better hedge to heavily weighted growth structured reinvestment. Fixed income allocations

allocations (such as equities) with modestly higher duration bonds. may create a better hedge to heavily weighted growth

Regardless of yield curve shape, asset allocation is crucial. Due to the allocations, such as equities.

fact that allocations to equities and fixed income depend largely on • Regardless of yield curve shape, asset allocation is

individual needs and goals, investing in fixed income assets requires crucial. Due to the fact that allocations to equities

disciplined, long-term planning. and fixed income depend largely on individual needs

and goals, investing in fixed income assets requires

disciplined, long-term planning.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Every investor's situation is unique and you should consider your investment

goals, risk tolerance and time horizon before making any investment. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Fixed income investments may

involve market risk if sold prior to maturity, credit risk and interest rate risk. Asset allocation does not ensure a profit or protect against a loss. The forgoing is not a recommendation to buy

or sell any individual security or any combination of securities.

18