Page 21 - ISQ January 2021

P. 21

JANUARY 2021

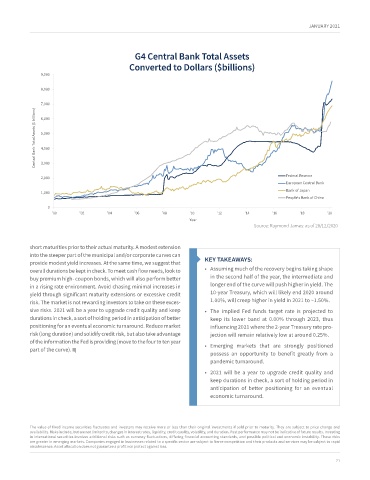

G4 Central Bank Total Assets

Converted to Dollars ($billions)

9,000

8,000

7,000

Central Bank Total Assets ($ billions) 5,000

6,000

4,000

3,000

Federal Reserve

2,000

European Central Bank

1,000 Bank of Japan

People's Bank of China

0

'00 '02 '04 '06 '08 '10 '12 '14 '16 '18 '20

Year

Source: Raymond James: as of 28/12/2020

short maturities prior to their actual maturity. A modest extension

into the steeper part of the municipal and/or corporate curves can

provide modest yield increases. At the same time, we suggest that KEY TAKEAWAYS:

overall durations be kept in check. To meet cash flow needs, look to • Assuming much of the recovery begins taking shape

buy premium high- coupon bonds, which will also perform better in the second half of the year, the intermediate and

in a rising rate environment. Avoid chasing minimal increases in longer end of the curve will push higher in yield. The

yield through significant maturity extensions or excessive credit 10-year Treasury, which will likely end 2020 around

risk. The market is not rewarding investors to take on these exces- 1.00%, will creep higher in yield in 2021 to ~1.50%.

sive risks. 2021 will be a year to upgrade credit quality and keep • The implied Fed funds target rate is projected to

durations in check, a sort of holding period in anticipation of better keep its lower band at 0.00% through 2023, thus

positioning for an eventual economic turnaround. Reduce market influencing 2021 where the 2-year Treasury rate pro-

risk (long duration) and solidify credit risk, but also take advantage jection will remain relatively low at around 0.25%.

of the information the Fed is providing (move to the four to ten year

part of the curve). • Emerging markets that are strongly positioned

possess an opportunity to benefit greatly from a

pandemic turnaround.

• 2021 will be a year to upgrade credit quality and

keep durations in check, a sort of holding period in

anticipation of better positioning for an eventual

economic turnaround.

The value of fixed income securities fluctuates and investors may receive more or less than their original investments if sold prior to maturity. They are subject to price change and

availability. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance may not be indicative of future results. Investing

in international securities involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks

are greater in emerging markets. Companies engaged in businesses related to a specific sector are subject to fierce competition and their products and services may be subject to rapid

obsolescence. Asset allocation does not guarantee a profit nor protect against loss.

21