Page 17 - ISQ January 2021

P. 17

JANUARY 2021

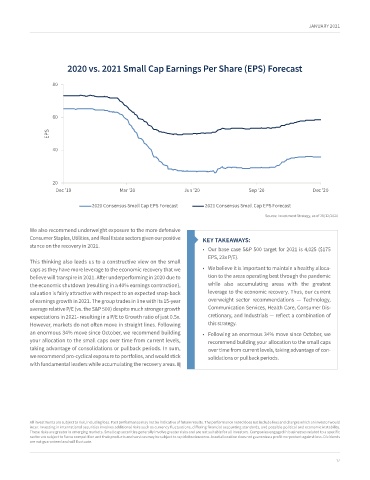

2020 vs. 2021 Small Cap Earnings Per Share (EPS) Forecast

80

60

EPS

40

20

Dec '19 Mar '20 Jun '20 Sep '20 Dec '20

2020 Consensus Small Cap EPS Forecast 2021 Consensus Small Cap EPS Forecast

Source: Investment Strategy, as of 28/12/2020

We also recommend underweight exposure to the more defensive

Consumer Staples, Utilities, and Real Estate sectors given our positive KEY TAKEAWAYS:

stance on the recovery in 2021.

• Our base case S&P 500 target for 2021 is 4,025 ($175

EPS, 23x P/E).

This thinking also leads us to a constructive view on the small

caps as they have more leverage to the economic recovery that we • We believe it is important to maintain a healthy alloca-

believe will transpire in 2021. After underperforming in 2020 due to tion to the areas operating best through the pandemic

the economic shutdown (resulting in a 40% earnings contraction), while also accumulating areas with the greatest

valuation is fairly attractive with respect to an expected snap-back leverage to the economic recovery. Thus, our current

of earnings growth in 2021. The group trades in line with its 15-year overweight sector recommendations — Technology,

average relative P/E (vs. the S&P 500) despite much stronger growth Communication Services, Health Care, Consumer Dis-

expectations in 2021- resulting in a P/E to Growth ratio of just 0.5x. cretionary, and Industrials — reflect a combination of

However, markets do not often move in straight lines. Following this strategy.

an enormous 34% move since October, we recommend building • Following an enormous 34% move since October, we

your allocation to the small caps over time from current levels, recommend building your allocation to the small caps

taking advantage of consolidations or pullback periods. In sum, over time from current levels, taking advantage of con-

we recommend pro-cyclical exposure to portfolios, and would stick solidations or pullback periods.

with fundamental leaders while accumulating the recovery areas.

All investments are subject to risk, including loss. Past performance may not be indicative of future results. The performance noted does not include fees and charges which an investor would

incur. Investing in international securities involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability.

These risks are greater in emerging markets. Small cap securities generally involve greater risks and are not suitable for all investors. Companies engaged in businesses related to a specific

sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Asset allocation does not guarantee a profit nor protect against loss. Dividends

are not guaranteed and will fluctuate.

17