Page 20 - Budget Newsletter - March 2023

P. 20

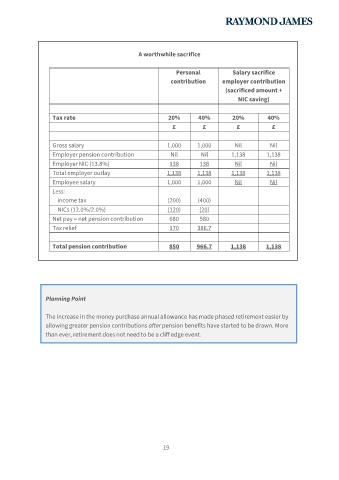

A worthwhile sacrifice

Personal Salary sacrifice

contribution employer contribution

(sacrificed amount +

NIC saving)

Tax rate 20% 40% 20% 40%

£ £ £ £

Gross salary 1,000 1,000 Nil Nil

Employer pension contribution Nil Nil 1,138 1,138

Employer NIC (13.8%) 138 138 Nil Nil

Total employer outlay 1,138 1,138 1,138 1,138

Employee salary 1,000 1,000 Nil Nil

Less:

income tax (200) (400)

NICs (12.0%/2.0%) (120) (20)

Net pay = net pension contribution 680 580

Tax relief 170 386.7

Total pension contribution 850 966.7 1,138 1,138

Planning Point

The increase in the money purchase annual allowance has made phased retirement easier by

allowing greater pension contributions after pension benefits have started to be drawn. More

than ever, retirement does not need to be a cliff edge event.

19