Page 16 - ISQ UK_October 2017

P. 16

INVESTMENT STRATEGY QUARTERLY

Q&A: US Company Consolidation (cont.)

have been able to grow their businesses. The five aforementioned

tech firms alone spent $100 billion last year on research and KEY TAKEAWAYS:

development (three times more than half a decade ago). These • The stock market is shrinking in terms of the number of

firms are definitely investing in the future. Finally, there is an publicly traded companies.

estimated $2.4 trillion in cash held by U.S. companies overseas that

is just sitting there not contributing much. Should tax reform occur • Consumers have benefited in a big way, with technological

next year and overseas cash comes home, Raymond James innovation helping to bring down costs and prices, while

estimates share buybacks and the repatriated cash could improve making lives more convenient and requiring less manual

S&P 500 earnings by an additional 1% - 2.5%. labour.

• Should tax reform occur next year, and the $2.4 trillion in

cash overseas comes home, Raymond James estimates share

buybacks and the repatriated cash could improve S&P 500

earnings by an additional 1% - 2.5%.

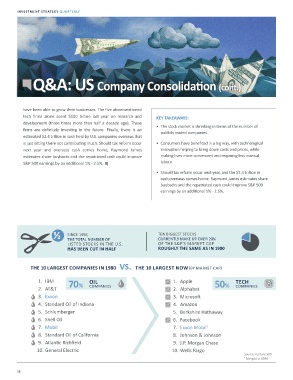

½ SINCE 1996, TEN BIGGEST STOCKS

CURRENTLY MAKE UP OVER 20%

THE TOTAL NUMBER OF

LISTED STOCKS IN THE U.S. OF THE S&P'S MARKET CAP

HAS BEEN CUT IN HALF ROUGHLY THE SAME AS IN 1980

THE 10 LARGEST COMPANIES IN 1980 VS. THE 10 LARGEST NOW (BY MARKET CAP)

1. IBM 70% OIL 1. Apple 50% TECH

2. AT&T COMPANIES 2. Alphabet COMPANIES

3. Exxon 3. Microsoft

4. Standard Oil of Indiana 4. Amazon

5. Schlumberger 5. Berkshire Hathaway

6. Shell Oil 6. Facebook

7. Mobil 7. Exxon Mobil 2

8. Standard Oil of California 8. Johnson & Johnson

9. Atlantic Richfield 9. J.P. Morgan Chase

10. General Electric 10. Wells Fargo

Source: Fortune 500

2 Merged in 1998

15