Page 24 - ISQ Outlook 2023

P. 24

INVESTMENT STRATEGY QUARTERLY

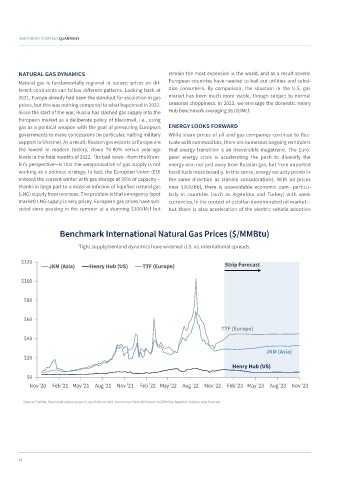

NATURAL GAS DYNAMICS remain the most expensive in the world, and as a result several

Natural gas is fundamentally regional in nature: prices on dif- European countries have needed to bail out utilities and subsi-

ferent continents can follow different patterns. Looking back at dize consumers. By comparison, the situation in the U.S. gas

2021, Europe already had been the standout for escalation in gas market has been much more stable, though subject to normal

prices, but this was nothing compared to what happened in 2022. seasonal choppiness. In 2023, we envisage the domestic Henry

Since the start of the war, Russia has slashed gas supply into the Hub benchmark averaging $6.00/Mcf.

European market as a deliberate policy of blackmail, i.e., using

gas as a political weapon with the goal of pressuring European ENERGY LOOKS FORWARD

governments to make concessions (in particular, halting military While share prices of oil and gas companies continue to fluc-

support to Ukraine). As a result, Russian gas exports to Europe are tuate with commodities, there are numerous ongoing reminders

the lowest in modern history, down 70-80% versus year-ago that energy transition is an irreversible megatrend. The Euro-

levels in the final months of 2022. The bad news—from the Krem- pean energy crisis is accelerating the push to diversify the

lin’s perspective—is that the weaponisation of gas supply is not energy mix: not just away from Russian gas, but from imported

working as a political strategy. In fact, the European Union (EU) fossil fuels more broadly. In this sense, energy security points in

entered the current winter with gas storage at 95% of capacity— the same direction as climate considerations. With oil prices

thanks in large part to a massive infusion of liquified natural gas near $100/Bbl, there is unavoidable economic pain—particu-

(LNG) supply from overseas. The problem is that emergency (spot larly in countries (such as Argentina and Turkey) with weak

market) LNG supply is very pricey. European gas prices have sub- currencies, in the context of a dollar-denominated oil market—

sided since peaking in the summer at a stunning $100/Mcf but but there is also acceleration of the electric vehicle adoption

Benchmark International Natural Gas Prices ($/MMBtu)

Tight supply/demand dynamics have widened U.S. vs. international spreads.

$120

JKM (Asia) Henry Hub (US) TTF (Europe) Strip Forecast

$100

$80

$60

TTF (Europe)

$40

JKM (Asia)

$20

Henry Hub (US)

$0

Nov '20 Feb '21 May '21 Aug '21 Nov '21 Feb '22 May '22 Aug '22 Nov '22 Feb '23 May '23 Aug '23 Nov '23

Source: FactSet, Raymond James research, as of 19/12/2022. Conversion from EUR/mwh to $/MMbtu based on futures strip forecast

24