Page 22 - ISQ UK_October 2017

P. 22

INVESTMENT STRATEGY QUARTERLY

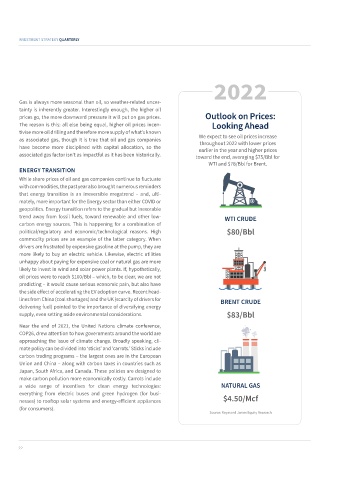

2022

Gas is always more seasonal than oil, so weather-related uncer-

tainty is inherently greater. Interestingly enough, the higher oil

prices go, the more downward pressure it will put on gas prices. Outlook on Prices:

The reason is this: all else being equal, higher oil prices incen- Looking Ahead

tivise more oil drilling and therefore more supply of what’s known

as associated gas, though it is true that oil and gas companies We expect to see oil prices increase

throughout 2022 with lower prices

have become more disciplined with capital allocation, so the earlier in the year and higher prices

associated gas factor isn’t as impactful as it has been historically. toward the end, averaging $75/Bbl for

WTI and $78/Bbl for Brent.

ENERGY TRANSITION

While share prices of oil and gas companies continue to fluctuate

with commodities, the past year also brought numerous reminders

that energy transition is an irreversible megatrend – and, ulti-

mately, more important for the Energy sector than either COVID or

geopolitics. Energy transition refers to the gradual but inexorable

trend away from fossil fuels, toward renewable and other low- WTI CRUDE

carbon energy sources. This is happening for a combination of

political/regulatory and economic/technological reasons. High $80/Bbl

commodity prices are an example of the latter category. When

drivers are frustrated by expensive gasoline at the pump, they are

more likely to buy an electric vehicle. Likewise, electric utilities

unhappy about paying for expensive coal or natural gas are more

likely to invest in wind and solar power plants. If, hypothetically,

oil prices were to reach $100/Bbl – which, to be clear, we are not

predicting – it would cause serious economic pain, but also have

the side effect of accelerating the EV adoption curve. Recent head-

lines from China (coal shortages) and the UK (scarcity of drivers for BRENT CRUDE

delivering fuel) pointed to the importance of diversifying energy

supply, even setting aside environmental considerations. $83/Bbl

Near the end of 2021, the United Nations climate conference,

COP26, drew attention to how governments around the world are

approaching the issue of climate change. Broadly speaking, cli-

mate policy can be divided into ‘sticks’ and ‘carrots.’ Sticks include

carbon trading programs – the largest ones are in the European

Union and China – along with carbon taxes in countries such as

Japan, South Africa, and Canada. These policies are designed to

make carbon pollution more economically costly. Carrots include

a wide range of incentives for clean energy technologies: NATURAL GAS

everything from electric buses and green hydrogen (for busi-

nesses) to rooftop solar systems and energy-efficient appliances $4.50/Mcf

(for consumers).

Source: Raymond James Equity Research

22