Page 8 - ISO April 2023

P. 8

INVESTMENT STRATEGY QUARTERLY

Opportunity cost: For those who were able to work remotely,

returning to an in-person job can be costly, especially for families

with young children, older parents, or those in other circum- We expect the Fed’s stance to remain hawkish

stances where a worker’s presence at home would be beneficial. for longer, rather than return to a more

In fact, sometimes the higher cost of services such as childcare accommodative stance.

and eldercare wipes out the benefit of having a dual-income

household. Additionally, many families enjoyed the flexibility of New research has been published since the start of the COVID-19

working from home, and many are having a hard time giving it up. pandemic addressing the potential changes that occurred in the

According to the Federal Reserve Bank of St. Louis, “the propor- US labour force. One of these papers, published in 2021 by econo-

tion of the population that reports being out of the labour force mists at the Federal Reserve Bank of San Francisco and titled “The

because of home care/family care” has increased considerably Divergent Signals about Labour Market Slack,” argued that “The

and has remained high after the end of the pandemic. 4

COVID-19 pandemic has disrupted the US labour market, causing

unprecedented deviations from the normal historical relationships

WHAT IS THE IMPORTANCE OF THE LABOUR FORCE among a wide range of labour market variables. Indicators related

FOR MONETARY POLICY?

to the manufacturing and small business sectors as well as to

A study by economists at the Federal Reserve Bank of Chicago in overall labour turnover suggest that there is less slack in the labour

2014 concluded that “the results from our models suggest that market than is reflected in the unemployment rate. By contrast,

there may indeed be greater slack in the labour market than is measures of labour force participation and the duration and rea-

signalled by the unemployment rate.” The importance of this sons for unemployment all show more slack than the

5

finding at the time was that “the existence of such extra slack

might imply that it would be appropriate for monetary policy to unemployment rate.”

remain highly accommodative for longer than would otherwise Another research paper concentrated on the effects of the Great

be the case.” In fact, the view that there was a larger labour slack Resignation on labour market slack and inflation, concluding that

during the pre-COVID-19 pandemic period kept the Fed highly “by applying for jobs in a different firm, employed workers can

dovish even in the face of very low rates of unemployment, as this spur wage competition between the current employer and pro-

greater slack in the labour market reduced the possibility of expe- spective employers. As a result, labour becomes more expensive

riencing increases in wages and salaries that would have to retain or to hire, effectively corresponding to a tighter labour

jeopardised the pursuit of the Fed’s inflation target of 2.0%. market from the perspective of employers.” 6

Today, the question of whether there is more or less slack in the Meanwhile, economists at the Dallas Federal Reserve wrote a

US labour market is one of the most consequential questions for research paper that also pointed to a tighter labour market than

monetary policy going forward, as it will determine how high and before the COVID-19 pandemic, saying that “Many employers

for how long the Fed is expected to remain hawkish/dovish on the

inflation front. throughout our district report that they are struggling to rehire

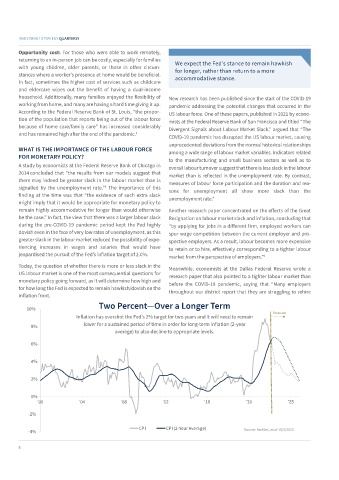

Two Percent—Over a Longer Term

10%

Forecast

Inflation has overshot the Fed’s 2% target for two years and it will need to remain

8% lower for a sustained period of time in order for long-term inflation (2-year

average) to also decline to appropriate levels.

6%

4%

2%

0%

'00 '04 '08 '12 '16 '20 '25

-2%

CPI CPI (2-Year Average) Source: FactSet, as of 19/3/2023

-4%

8